How to create a holiday budget and stick to it

In this blog post, we'll provide tips on how to create a holiday budget and stick to it so you can enjoy the season without breaking the bank. Whether you're looking to save money on gifts, travel, or events, we've got you covered.

Business reliance for retirement income

The article focuses on the potential dangers of relying solely on the sale of a business to finance retirement, and offers steps on how to prepare for the sale or succession of your business, such as building up superannuation.

Banking vultures slammed after widowed single mum loses house

Protecting Your Loved Ones: The Importance of Death Benefit Nominations for Superannuation and InsuranceAs financial advisers, we often emphasize the importance of comprehensive estate planning to our clients. Yet, the story of Stephanie Stevens…

The first rule of fight club don’t talk about fight club

Financial Lessons from Fight Club: Punching Debt in the Face and Building WealthHey, savvy investors! Today, we're diving into the gritty world of Fight Club to uncover some unexpected financial wisdom. You might be scratching your head and…

Do you and your family need life insurance?

Most people are familiar with life insurance, but fewer are familiar with self-insurance. Self-insurance includes borrowing money, selling assets, or using cash savings in the event of death, as opposed to paying for an insurance policy.

How much life insurance you need

When it comes to how much life insurance you need, it’s a bit like “How long is a piece of string?” (2 times half its length). What this means is that its is going to be different for everyone and depends on what your circumstances and goals are.

Life insurance in retirement – what you need to know

As you head towards retirement, it's important to think about what insurance you need. What kind of coverage are you looking for? Do you want to cover your retirement income? There are a variety of options available, so it's important to do your homework and find the right fit for you.

Costs of keeping up with the Joneses

A popular quote about money and happiness states that while money cannot directly buy happiness, it can provide the means to enjoy experiences and possessions that can bring happiness.

Can a US recession be a good thing?

The hot topic at the moment seems to be about the US recession and whether it will avoid it or go into it. But we are in Australia, so should we care? Well, unfortunately our market sentiments are largely connected, so if the US sneezes, we catch a cold.

Ways to avoid credit card debt – learn 4 methods

This article emphasizes the importance of managing credit cards and provides simple suggestions for using them as a tool for effective money management.

What are exchange traded funds?

Have you ever heard of Exchange Traded Funds (ETFs)? You might have some but not know what they are. As investors, we are always looking for ways to grow our portfolio and protect our savings. One way to do this is by investing in exchange traded funds (ETFs).

What are retirement income streams?

Everyone's idea of retirement is different. For some, it means travelling the world and never having to work again. However you choose to spend your retirement, one thing is for sure: you'll need a reliable stream of income to make it happen.

How do I apply for an age pension?

For those of us who have worked hard our entire lives, receiving an age pension can be a bit of a shock. It doesn't seem fair that after contributing so much to society, we are now considered charity cases. Thankfully, the application process for age pensions in Australia is straightforward, and there are plenty of resources available to help you through it.

Six steps to effective debt management

Australian households are among the most indebted in the world, and it is crucial to take action now to avoid losing everything. This article provides six key steps for effective debt management that will help you quickly and efficiently get your cash flow back on track.

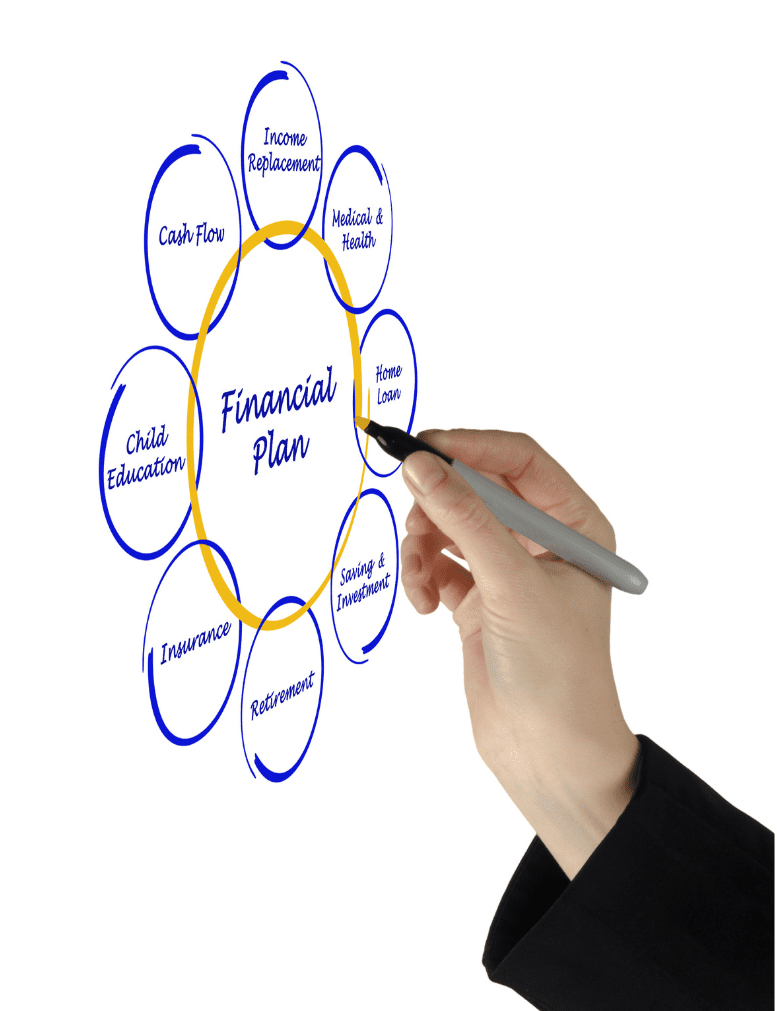

What good is a financial plan without a regular review

When it comes to financial planning, many people think that they are done once they have put together a plan. However, this could not be further from the truth! A good financial plan is one that is regularly reviewed and updated.

How to stop living paycheck to paycheck?

The article explains that living paycheck to paycheck is not a desirable situation, but rather a financial emergency. It provides advice on how to break the cycle of constantly needing to rely on each paycheck to get by, through making better financial decisions and getting back on track with one's expenses.

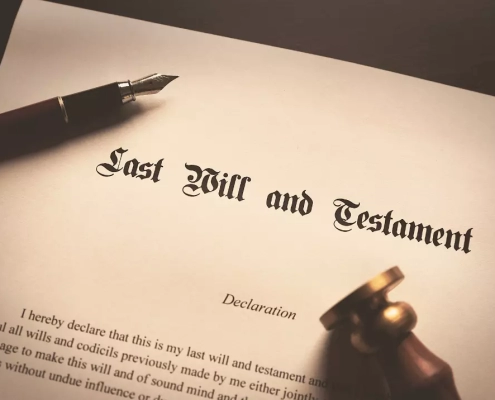

Responsibilities of the executor of a will

If you're considering taking on the role of an executor for a will, this article is a must-read. It outlines the responsibilities of the executor of a will and helps you understand what to consider before taking on such an important role.

Do you need income protection insurance?

Many people think that their income is safe until they lose their job. But what would you do if you lost your income tomorrow? Protect yourself with Wealth Factory’s income protection insurance advice and rest easy knowing that you and your family are taken care of financially.

Everything you need to know about life insurance in Australia

When it comes to life insurance, there is a lot of information to take in. Here, we provide an overview of how life insurance works in Australia, including the different types of policies available and how premiums are calculated.

Should you consider a testamentary trust?

Do you have concerns about what will happen to your loved ones after you pass away? This article provides an overview of testamentary trusts and how they can be utilised in estate planning.

Estate planning: Avoiding inheritance headache

In this article, we follow a grieving daughter as she deals with the loss of her mother and the task of sorting out her mother's estate. She must figure out how to use her inheritance wisely through estate planning.

An important conversation with parents (and kids)

Older people tend to be very private when it comes to topics such as their finances, estate planning, and aged care. This article offers guidance on how to initiate open and productive discussions with an elderly relative and your children.

Should I change my risk level when markets are volatile?

There's no doubt that the stock market has been incredibly volatile throughout 2022 so far. Making a change in your risk level based on market conditions can be tricky. Let’s take a closer look at when it might be appropriate to make a switch and when it's better to stay the course.

Your bank account is only as safe as your weakest password

Protecting your information online is becoming increasingly important as cyber attacks are increasing over time, especially in the health sector. There have been many successful attacks on large businesses, universities, and even government agencies that have been victims.

How does inflation impact your portfolio?

Hope for the best, plan for the worst. Inflation is back after 40 years - how does inflation impact client portfolios?

The Female Investor

This article will discuss the rise of female investors and the differences in their investing strategies compared to men.

How to go broke trying to get rich quick

Can you really become wealthy from a get-rich-quick scheme? This article addresses the many “investment opportunities”, both legal and illegal, that promise big returns over a short period of time, explaining the risks associated with each, and the importance of professional advice.

What is money?

This article provides an overview of the concept of money and currency. It covers the history of banking and money, and explains the key characteristics of money. Additionally, it discusses the evolution of money from its origins to the current day.

Why invest in index funds Australia

This article provides an overview of index funds, including how to access them, their advantages and disadvantages, tips and tricks on how to get the most out of your index fund investments, and concludes with a recommendation to consult a financial planner for further guidance.

Investment Risk Management

Volatility in the financial markets is nothing new. Asset prices have always experienced ups and downs, and there will always be risks inherent in investing. However, it's important to remember that investing is a long-term play and the investment risk management is key.

Importance of Record Keeping in Small Business

According to the Australian Taxation Office (ATO), poor record-keeping is a common reason for the failure of small businesses. In addition to being a legal requirement, maintaining accurate records can have numerous financial benefits.

What rising inflation means for you

The word “inflation” has been largely ignored by a whole generation until now. The Reserve Bank of Australia predicts that our underlying inflation will rise to around 6% in the second half of 2022. But what is inflation and how does it impact you?

What will a labor win mean for markets?

The Labor’s election victory marks the end of the Coalition’s almost decade long reign. Regardless of the election outcome, the bigger question will be being able to govern effectively in a world of higher inflation and interest rates.

How to Save More Money for Retirement?

Are you looking for ways on how to save more money for retirement but don't know where to start? You're not alone! In this post, we'll outline some tips for how to save money when you retire in Australia.

Tax Planning: Forward Planning Reaps Rewards

The tax planning is the process of arranging your affairs in such a way as to minimise your tax liability. It involves looking at both your current situation and anticipating any changes that may occur in the future.

Your Retirement Planning Checklist 2022

Imagine a world where we can finally quit working — where we don't have to go to work every day but still get paid. Sounds like a dream, doesn’t it? All it takes is a well-thought-out retirement planning strategy tailored to your specific requirements.

Five Proven Ways to Decrease Taxes

Benjamin Franklin's famous quote, "In this world, nothing can be said to certainly exist, except death and taxes," is just as true today as when it was first said. The only thing that has changed over the years when it comes to taxes is the taxation law-with so many options available.

Step-by-Step Guide to Retirement Living

Are you getting close to retirement and feeling a little lost about what to do? Or maybe you're already retired and looking for ways to make the most of your golden years? Whatever your situation, this step-by-step guide to retirement living will help you every step of the way.

Keys to a Successful Retirement

When it comes to retiring in Australia, there are a few things that you need to take into account. In this blog post, we'll take a look at the keys to a successful retirement in Australia. So read on and see if any of these strategies could work for you.

Financial Planning: Looking at the Past to Plan Ahead

Financial planning means planning for the future. If you want to plan for the future, you should take a look at your current situation, assess and then write down what you want to do in the years to come. You can do financial planning yourself or you can do it through a financial planner.

12 Important Questions for a Financial Checkup

Financial Checkup is an opportunity to review your financial situation over the past year and ensure that you are still managing your money effectively. It is a good time to take stock of your income, expenses, etc., and make any necessary adjustments to ensure that you are on track to meet your financial goals.

Australian Federal Budget 2022 Summary

With the federal election only a couple of months away, it was no surprise to see an Australian federal budget filled with announcements that will appeal to the life of voters – such as cost-of-living relief payments, tax cuts, improved parental leave, small business incentives, and investing in healthcare and essential services.

Is the Australian entrepreneur in you calling?

The Australian Small Business and Family Enterprise Ombudsman reported that the number of small and micro businesses in Australia has significantly increased in 2020. If you are considering starting a home-based business in Australia, here are some tips to help you get started.

Financial Resolutions to Start the New Year

Many people set financial goals as New Year's resolutions in order to achieve bigger and better things. These goals can help you save money and improve your financial situation. If you want to set financial resolutions, here are some suggestions that can help.

Are credit cards retiring in 2022?

Credit cards have been the dominant form of financial payment for the last 40 years, but recently, there has been a shift towards other financial media to reduce charges and costs. Despite the rise of new financial media in Australia, the use of credit cards decreased.

How to maintain Strategic Financial Plan

Financial planning allows you to assess your present condition and plan for your financial future in life so you don't make the same mistakes you made in the past. You may have more control over your finances by creating a strategic financial plan. You make money work for you rather than the other way around.

Your future your super bill passed 2022

Significant advice opportunities have been created, particularly for older clients, as a result of the passing of the 2021 Federal Budget super proposals. We summarise the Your Future, Your Super reforms to help you navigate the new rules as well as highlight key advice opportunities to maximise client outcomes in 2022 and beyond.