What are retirement income streams?

Table of Contents

ToggleEveryone’s idea of retirement is different. For some, it means travelling the world and never having to work again. Others see it as an opportunity to finally focus on their hobbies and spend more time with their families. However you choose to spend your retirement, one thing is for sure: you’ll need a reliable stream of income to make it happen.

In this blog post, we’ll explore the different types of retirement income streams available to retirees and help you find the right one for you. So sit back, relax, and let us teach you how to make money.

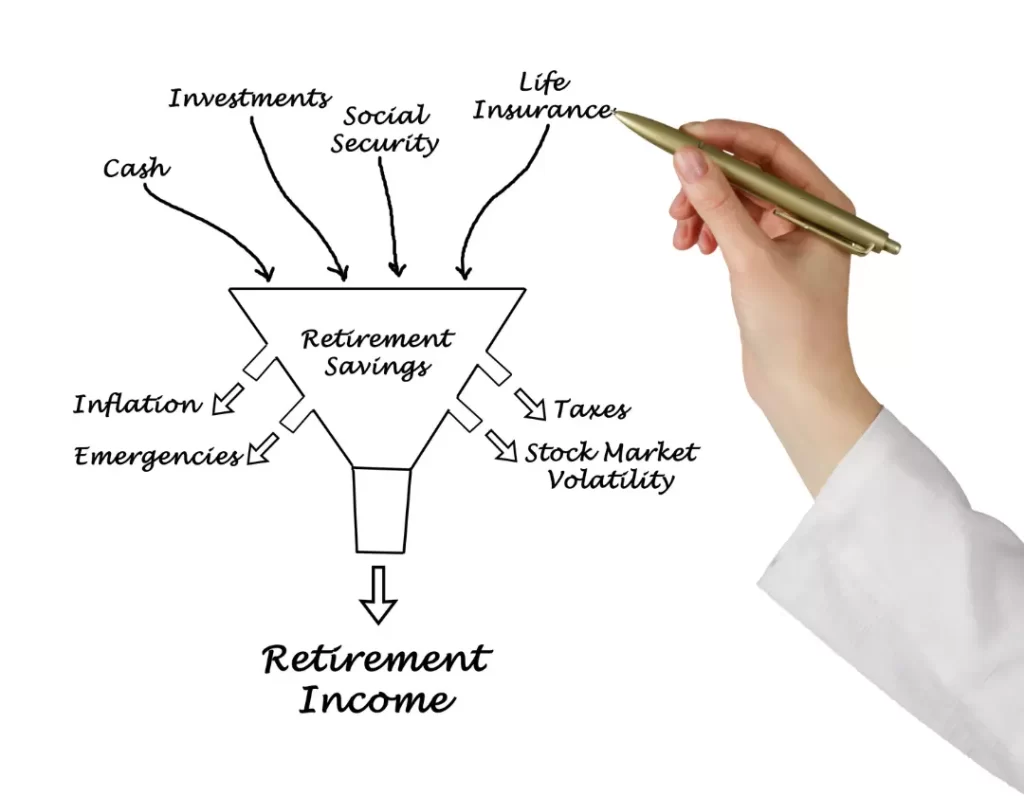

Retirement income stream is an income received by a person after retirement. Retirement income streams can come from different sources, such as the government, private companies, or individual retirement savings.

Retirement income streams can be used to cover the costs of living, such as food, housing, and healthcare. They can also be used to travel, purchase leisure items, or to help family and friends. Retirement income streams are an important part of retirement planning, and it is important to understand the different types of retirement income streams available.

Types of Retirement Income Streams

When it comes to retirement planning, one of the most important things you can do is to set up a retirement income stream. This will provide you with a regular source of income in retirement, which can help you cover your basic living expenses and enjoy a comfortable lifestyle.

There are a few different types of retirement income streams available in Australia, so it’s important to understand your options before making a decision. Here’s a brief overview of the most popular types of retirement income streams in Australia:

Superannuation

Superannuation is a compulsory retirement savings scheme for employees in Australia. If you’re employed, your employer must make contributions to your super fund on your behalf (usually equal to 9.5% of your salary). You can also make additional contributions to your super fund if you wish.

Age Pension

The Age Pension is a government-funded retirement income stream for eligible Australians. To be eligible, you must meet certain age, residency, and income requirements. If you’re eligible, you’ll receive a regular payment from the government that can help cover your basic living expenses in retirement.

Annuities

An annuity is an insurance product that provides you with a regular income stream in retirement. You can purchase an annuity with your superannuation savings or other retirement savings (such as a lump sum from the sale of your home).

Investments

Another option for generating retirement income is to invest your savings in growth assets such as shares, property or managed funds. This can provide you with a regular income stream in retirement, but there is also the potential for capital gains (or losses) over time.

When choosing a retirement income stream, it’s important to consider your personal circumstances and objectives. You may wish to speak to a financial adviser to get professional advice on the best retirement income stream for you.

Are retirement income streams taxable?

Are retirement income streams taxable in Australia? The answer may surprise you.

As we all know, retirement is a time when we finally get to relax and enjoy the fruits of our labour. After years of working hard and saving for the future, retirement is often seen as a chance to finally kick back and enjoy life.

However, one important question that many people don’t think about until it’s too late is: are retirement income streams taxable in Australia?

Unfortunately, the answer is yes. Retirement income streams are considered taxable income in Australia and are subject to the same tax rules as other forms of income. This means that if you’re receiving a retirement income stream, you may be required to pay taxes on it.

There are a few different types of retirement income streams, and each one has its own tax rules. For example, pensions and annuities are taxed differently to superannuation income streams.

The good news is that there are some tax concessions available for retirement income streams. For example, the government offers a seniors and pensioners tax offset (SAPTO), which can help reduce the amount of tax you need to pay on your retirement income.

If you’re receiving a retirement income stream, it’s important to speak to a qualified accountant or tax agent to make sure you’re paying the right amount of tax. Ignorance is no excuse when it comes to taxes, so make sure you’re up to date on the latest tax rules.

Tips on how to make the most of your retirement income stream

There are a few different retirement income streams available to Australians, and it can be difficult to know which one is right for you. Here are some tips on how to make the most of your retirement income streams.

The first thing you need to do is understand what retirement income streams are available to you. There are a few different options, and there is no one-size-fits-all approach, so it’s important to do your research and understand the option that best suits your individual needs.

Once you know what retirement income streams are available, you need to consider your personal circumstances and decide which one is right for you. You need to think about things like your age, health, lifestyle, and financial situation.

Once you’ve decided which retirement income stream is right for you, the next step is to start planning for retirement. This means saving as much money as you can and investing it in a way that will give you the best chance of achieving your retirement goals.

Another tip is to think about how long you want each retirement income stream to last. Some options will provide an income for life, while others may only last for a set number of years. Choose the option that best suits your retirement goals.

Lastly, make sure you keep track of all your retirement income streams and how they are performing. This will help you make any necessary adjustments along the way to ensure you are making the most of your retirement savings.

There are a few different ways to save for retirement, so it’s important to find one that suits your circumstances. You might want to consider things like salary sacrificing, superannuation, or a retirement savings account.

The most important thing is to start planning for retirement as early as possible. The sooner you start, the more time you have to save and the more likely you are to achieve your retirement goals.

If you’re approaching retirement and don’t have enough saved, there are still a few things you can do to improve your situation. You might want to consider working part-time or finding ways to boost your income.

No matter what your retirement goals are, there are a few things you can do to make the most of your retirement income streams. By doing your research, planning ahead, and making the most of your money, you can enjoy a comfortable retirement.

That’s a lot to think about when it comes to retirement income streams, but don’t worry, we can help. Wealth Factory offers complimentary reviews of your insurance policies and investments as part of your financial plan. We want to make sure you have the best chance for a comfortable retirement, so get in touch today.