How to create a holiday budget and stick to it

Table of Contents

ToggleAs the holiday season approaches, it’s easy to get caught up in the excitement and splurge on gifts and festivities. However, it’s important to set a budget and stick to it to avoid overspending and stressing out about finances later on.

In this blog post, we’ll provide tips on how to create a holiday budget and stick to it so you can enjoy the season without breaking the bank. Whether you’re looking to save money on gifts, travel, or events, we’ve got you covered. So, let’s get started on creating a budget that works for you!

Why it's important to create a holiday budget

The holiday season is a time for celebration and spending time with loved ones, but it can also be a time of financial stress if you’re not careful. That’s why it’s so important to create a holiday budget.

A holiday budget allows you to set limits on your spending and make sure you’re not overspending or going into debt. It can help you prioritise your spending and ensure that you’re able to afford the things that are most important to you.

Creating a budget also helps you avoid the post-holiday financial hangover that many people experience. You’ll be able to enjoy the holiday season without worrying about how you’ll pay for everything.

Additionally, a holiday budget can help you stick to your long-term financial goals. If you’re trying to save money or pay off debt, a holiday budget can help you stay on track and avoid setbacks.

Overall, creating a holiday budget is a smart and responsible way to approach the holiday season. It can help you stay financially stable and enjoy the holidays without stress or worry. So don’t wait – start planning your holiday budget today!

The benefits of sticking to a budget

Sticking to a budget during the holiday season can have a number of benefits that will not only help you financially, but also help you enjoy the holiday season to the fullest.

Avoid overspending

One of the biggest benefits of sticking to a budget during the holiday season is that it helps to prevent overspending and financial stress. With all the gift-giving and festive events, it’s easy to get caught up in the spending frenzy and end up with a hefty credit card bill come January.

By setting a budget and sticking to it, you can avoid this financial stress and enjoy the holiday season without the burden of debt.

More time for important things

Another benefit of sticking to a budget is that it allows you to focus on what really matters during the holiday season. Instead of stressing about how much you’re spending, you can spend your time and energy on creating meaningful experiences and memories with your loved ones.

Whether it’s cooking a special holiday meal or taking a trip to a winter wonderland, a budget can help you prioritise what matters most and make the most of your holiday season.

More meaningful gifts

Additionally, sticking to a budget can also help you be more thoughtful and intentional with your gift-giving. Instead of just buying whatever is on sale or something that’s trendy, you can take the time to really consider what your loved ones would appreciate and what you can truly afford. This can help make your gift-giving more meaningful and heartfelt, rather than just another financial obligation.

The benefits of sticking to a budget during the holiday season are numerous. Not only will it help prevent financial stress and overspending, it will also allow you to focus on what really matters and be more thoughtful and intentional with your gift-giving. So take the time to set a budget and stick to it this holiday season, and you’ll be able to fully enjoy all the festive cheer without any financial worries.

Determine your holiday expenses

As the holidays draw near, it’s essential to begin planning your holiday spending. This includes everything from gifts for friends and family, travel costs, and entertainment expenses. It’s crucial to budget wisely to make the most of the holiday season.

Gifts for friends and families

One of the biggest expenses during the holiday season is gifts for friends and family. Whether you’re planning on buying presents for everyone on your list or just a few special people, it’s important to set a budget for this expense.

Consider making a list of everyone you need to buy for and setting a maximum amount you can spend on each person. This will help you stay on track with your holiday spending and ensure that you don’t overspend.

Travel expenses

Travel expenses are another important consideration when budgeting for the holidays. If you’re planning on visiting family or friends, you’ll need to budget for things like airfare, hotel accommodations, and rental car fees. It’s a good idea to start looking at travel options early to get the best prices and consider alternative modes of transportation, like taking the train or driving, to save money.

Entertainment and activities

Entertainment and activities during the holidays can also add up quickly. Whether it’s tickets to a holiday show or activity, such as ice skating or tree lighting, it’s important to consider these expenses as well. Make a list of the activities you want to do and budget accordingly.

Food and beverages

Food and beverages are another important holiday expense to consider. Whether you’re hosting a holiday dinner or just need to buy food for entertaining, it’s important to budget for this expense. Don’t forget to factor in any special treats or beverages that you’ll be serving.

Miscellaneous expenses

Miscellaneous expenses, such as decorations, cards, and wrapping paper, can also add up quickly. Be sure to budget for these items as well to ensure that you don’t overspend during the holiday season.

It’s important to determine your holiday expenses ahead of time to ensure that you have a happy and stress-free holiday season. By setting a budget and planning ahead, you can enjoy the holiday season without breaking the bank.

Tips for setting a realistic budget

The holiday season is a time for celebration, but it can also be a time of financial stress if you don’t set a realistic budget. Here are a few tips to help you stay on track with your spending and avoid overindulging:

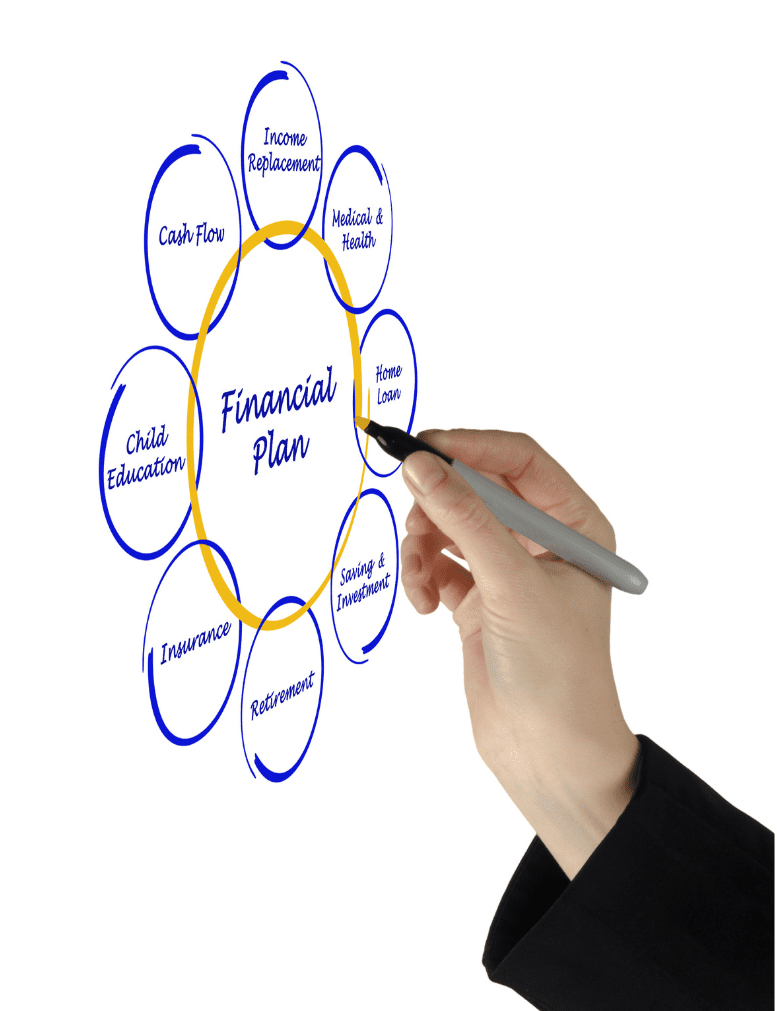

Determine your holiday spending goals

Before you start shopping, take a moment to think about what you want to achieve financially during the holiday season. Do you want to pay off credit card debt, save for a down payment on a home, or simply avoid overspending? Setting clear goals will help you stay focused on what matters most to you.

Make a list of all your holiday expenses.

From gifts to travel to party supplies, list out every single thing you expect to spend money on during the holiday season. This will help you get a better sense of your total budget and where you can make cuts if necessary.

Set a budget for each category

Once you have your list of expenses, assign a budget to each category. Be realistic about what you can afford to spend and stick to it as closely as possible.

Shop around for the best deals

The holiday season is a great time to take advantage of sales and discounts. Do your research and compare prices before making a purchase to make sure you’re getting the best deal.

Don't forget about non-gift expenses

It’s easy to focus on gift-giving during the holidays, but don’t forget about all the other expenses that come with the season. These could include things like travel, party supplies, and decorations.

Consider alternative gift options

If you’re on a tight budget, consider alternative gift options like homemade gifts, regifting, or offering your time and services as a gift instead of buying something.

Save your extra cash

If you’re able to stick to your budget and have some extra cash left over, consider saving it for future holiday seasons or using it to pay down debt.

By following these tips, you can set a realistic budget for the holiday season and avoid financial stress while still enjoying all the joy and celebration that the season has to offer.

Conclusion

Creating a holiday budget and sticking to it can be a challenging but rewarding task. By setting clear financial goals, keeping track of your spending, and finding ways to save money, you can enjoy the holiday season without breaking the bank. Remember to also be flexible and open to making adjustments to your budget as needed.

With a little planning and discipline, you can make your holiday season stress-free and financially manageable. Happy budgeting and happy holidays!