What good is a financial plan without a regular review

Why is it vital to review and update the financial plan?

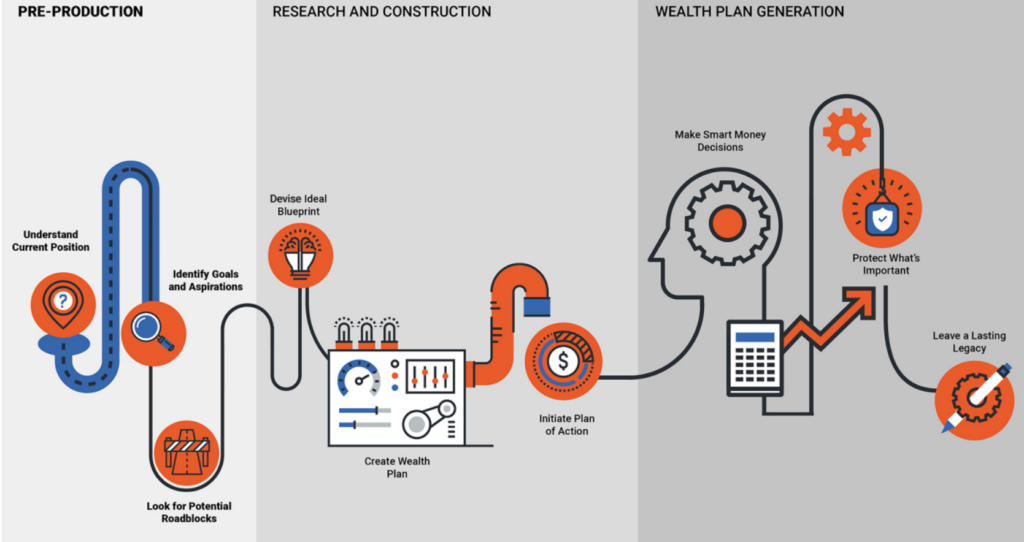

When it comes to financial planning, many people think that they are done once they have put together a plan. However, this could not be further from the truth! A good financial plan is one that is regularly reviewed and updated. This is where a good financial adviser comes in – someone who can help you review your progress and make necessary adjustments.

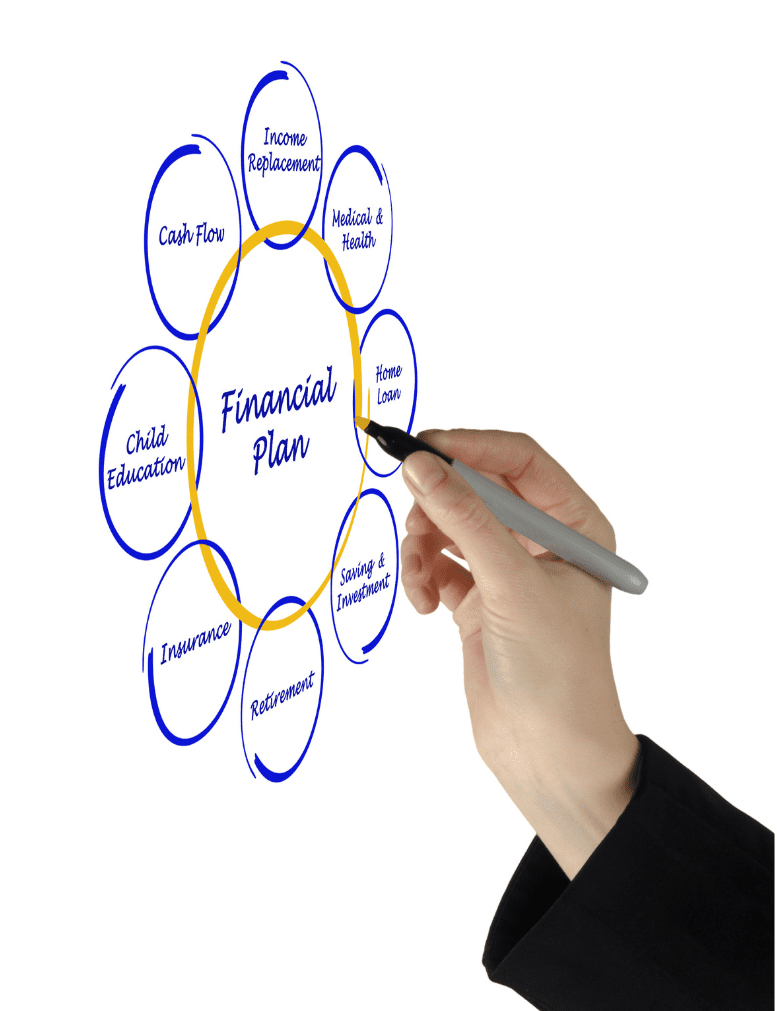

Regardless of how much money you make, it’s always a good idea to have a financial plan. A financial plan includes setting goals, tracking progress, and reviewing your progress on a regular basis. A financial planner can help you create a long-term financial plan that fits your unique circumstances.

Reviewing your financial plan on a regular basis allows you to make adjustments as needed and keep track of your progress. It’s also a good way to identify any potential problems so that you can address them before they become serious.

Benefits of reviewing your financial plan regularly

There are many benefits of reviewing your finances regularly, including peace of mind, reduced stress, and increased savings. Here are a few more benefits of reviewing your financial plan regularly:

- A financial plan is a roadmap to help you achieve your financial goals. It should include your income, expenses, savings, and investment goals. A financial planner can help you create and maintain a strategic financial plan that fits your unique situation. They can also help you stay on track and make changes as your life changes. Financial planning is important for everyone, regardless of age or income. If you don’t have a financial plan, now is the time to create one.

- Reviewing your financial plan regularly can help ensure that you’re on track to reach your goals. Reviewing your financial plan on a regular basis can help ensure that you’re on track to reach your goals. This process can also help you identify any potential problems or areas where you may need to make adjustments. Of course, financial planning is not a one-time event. Your circumstances will change over time, so it’s important to review your financial plan regularly and make changes as needed. By doing this, you can help keep yourself on track to financial success.

- Financial planning software can make it easy to review your finances regularly. By reviewing your finances regularly, you can catch any potential problems early and take corrective action. Financial planning software makes it easy to see where your money is going and how much you have left to save or invest. It can also help you create a budget and track your progress over time. If you are not sure where to start, there are many financial planning software programs available online. Do some research and find one that fits your needs. Financial planning software can help you take control of your finances and reach your financial goals.

- Financial planning is like flossing: you know you should do it, but it’s not always at the top of your mind. However, by making financial planning a regular part of your routine, you can be confident that you’re doing everything possible to reach your financial goals. Reviewing your financial plan on a regular basis can help you stay on track and make adjustments as needed. And just like brushing your teeth, the sooner you start financial planning, the better off you’ll be in the long run. So don’t wait until tomorrow to start financial planning for your future – today is the day to take control of your finances.

A financial adviser can help you set realistic goals and monitor your progress toward them. Whether you are working towards saving for a down payment on a house, paying off your student loans, or simply building up an emergency fund, having someone to guide you and hold you accountable can be an invaluable tool. Accountability is an important aspect of achieving goals, whether that be exercising, dieting or using your money wisely.

An ongoing relationship with a financial planner gives you access to the latest industry insights and strategies. This can help ensure that your investments are always performing at their best, no matter what the market conditions may be. Your adviser will also be up to date on changes to the superannuation tax breaks. Your adviser can review strategies and find opportunities that may be relevant to you.

An adviser can also give you expert advice on all aspects of personal finance, from budgeting and investing to retirement planning and insurance coverage. Having someone who is knowledgeable about these topics will give you peace of mind and help you feel confident in your financial choices.

Five benefits of having an ongoing relationship with a financial adviser:

- A financial adviser can be a great asset when it comes to saving money. They can help you to invest your money wisely and make sure that you are getting the most out of your financial situation. They can also help you to set up a budget and stick to it, which can be a difficult task for many people. In the long run, a financial adviser can help you to save a great deal of money.

2. When it comes to retirement planning, there are a lot of moving parts. You’ve got your savings, your investments, your budget, and more. It can be tough to keep track of everything, let alone make progress towards your goals. That’s where a financial adviser can be a big help. By reviewing your progress regularly, they can keep you on track and help you make adjustments as needed. They can also offer guidance on difficult decisions, such as when to claim government benefits or how to invest appropriately for your situation. In short, an ongoing relationship with a financial adviser can be a great way to ensure a successful retirement.

3. Having an ongoing relationship with a financial adviser is beneficial because it helps you stay disciplined with your money and strategies. A financial adviser can review your progress regularly and help you make changes to your financial plan if needed. They can also help you set financial goals and provide guidance on how to achieve them. If you are not disciplined with your money, you may end up spending more than you can afford or making poor financial decisions. A financial adviser can help you avoid these mistakes and keep your finances on track.

4. As anyone who has ever tried to save for a financial goal knows, it can be difficult to stay on track. Life happens, and unexpected expenses always seem to pop up when you can least afford them. This is where having a ongoing relationship with a financial adviser can really help.

A good financial adviser will review your progress regularly and make sure you are still on track to reach your goals. This gives you peace of mind, knowing that someone is keeping an eye on your finances and making sure everything is going according to plan. Plus, if anything changes in your life (such as a job loss or a major purchase), your financial adviser can help you adjust your plan accordingly. In short, an ongoing relationship with a financial adviser provides peace of mind and helps ensure that you will ultimately achieve financial success.

5. It’s important to find the right adviser for you. Many people think that financial advisers are only for the wealthy. But the truth is, financial advisers can offer valuable insights and guidance for people of all income levels. Having an ongoing relationship with a financial adviser can help you make sound financial decisions, reach your financial goals, and navigate life’s financial challenges. But finding the right financial adviser is important. You want someone who is knowledgeable and experienced, but also someone who you feel comfortable communicating with and who shares your values. With so many financial advisers out there, it can be difficult to find the right one. But it’s worth taking the time to find someone who you can trust and who will be a valuable partner in your financial journey.

Overall, having an ongoing relationship with a financial adviser can be an essential part of meeting your financial goals. There are many benefits to having a financial adviser, including saving money in the long run, being able to plan for retirement, staying disciplined with finances, and having peace of mind. However, it’s important to find the right adviser for you.

A good place to start is by looking for someone who offers a free consultation so that you can get to know them and their process before committing to anything. At Wealth Factory, we offer free consultations because we believe that it’s important for our clients to feel comfortable with us before making any decisions. We want to help you achieve your financial goals and we believe that regular review of your finances is an important part of achieving those goals.

Financial planning software makes it easy to review your finances regularly so that you can be confident that you’re on track. Schedule a free call today to learn more about how Wealth Factory can help you reach your financial goals. So if you haven’t already, consider reaching out to an adviser today and start working towards a brighter financial future!