How does debt consolidation work?

Table of Contents

ToggleIf you’re struggling with multiple debts and finding it difficult to keep up with various payments, debt consolidation could be the solution you’ve been looking for. In this blog post, we will break down the concept of debt consolidation and explain the process in simple terms.

Understanding how debt consolidation works is essential to make informed decisions about your financial situation. Whether you’re drowning in credit card bills, student loans, or other types of debt, debt consolidation can offer relief and help you regain control over your finances.

How does debt consolidation work?

Debt consolidation simplifies the repayment process by combining multiple debts into a single loan or repayment plan. This can help you manage your debts more efficiently and potentially save money in the long run.

Let’s explore the process of how debt consolidation works.

Debt consolidation loan

A debt consolidation loan is a new loan obtained to pay off existing debts. Instead of making separate payments to multiple creditors, you consolidate your debts by borrowing a lump sum from a lender. This allows you to pay off all your existing debts and focus on repaying just one loan.

Steps involved in debt consolidation

Debt consolidation typically involves the following steps:

Assessment of current debts

Begin by evaluating your current debts, including their outstanding balances, interest rates, and repayment terms. This will give you a clear understanding of your overall debt situation.

Researching and comparing options

Explore different lenders and debt consolidation programs to find the one that best suits your needs. Consider factors such as interest rates, repayment terms, fees, and eligibility requirements.

Applying for a debt consolidation loan

Once you’ve chosen a suitable option, submit an application for a debt consolidation loan. The lender will assess your creditworthiness and financial situation to determine if you qualify for the loan.

Paying off existing debts

If your loan application is approved, the lender will provide the funds needed to pay off your existing debts. This may involve directly paying off your creditors or providing you with the funds to do so.

Repaying the consolidation loan

After consolidating your debts, you’ll have a single monthly payment to make towards the consolidation loan. It’s important to make timely payments to ensure you stay on track and avoid accumulating more debt.

Types of debt consolidation methods

There are various methods of debt consolidation, including:

Secured debt consolidation

This involves using collateral, such as a home or other valuable asset, to secure the consolidation loan. Secured loans generally offer lower interest rates but come with the risk of losing your collateral if you default on payments.

Unsecured debt consolidation

Unsecured loans do not require collateral and are based on your creditworthiness. These loans may have higher interest rates compared to secured loans, but they eliminate the risk of losing collateral.

Balance transfer credit cards

Another option is to transfer high-interest credit card balances to a new card with a lower interest rate or a promotional 0% APR period. This method can be effective if you can pay off the balance within the promotional period.

Home equity loans or lines of credit

If you own a home, you may have the option to borrow against your home’s equity. This allows you to consolidate debts using the value of your property. However, it’s important to consider the risks involved and ensure you can afford the repayments.

Understanding how debt consolidation works and exploring the available methods will help you choose the most suitable option for your financial situation.

Advantages and disadvantages of debt consolidation

Debt consolidation offers several advantages that can make it an attractive option for individuals seeking to manage their debts more effectively. However, it’s important to consider the potential drawbacks as well.

Let’s explore the advantages and disadvantages of debt consolidation:

Advantages of debt consolidation

Simplified repayment process

Debt consolidation simplifies your repayment process by combining multiple debts into a single monthly payment. Instead of juggling numerous due dates and amounts, you only need to keep track of one payment, making it easier to stay organised and reduce the chance of missing payments.

Potential for lower interest rates

One of the key benefits of debt consolidation is the potential to secure a lower interest rate on the consolidation loan compared to the rates of your existing debts. This can save you money on interest charges over time, allowing you to pay off your debts more efficiently.

Single monthly payment

With debt consolidation, you’ll have a single monthly payment to make towards the consolidation loan. This can help you budget more effectively and eliminate the stress of managing multiple payments.

Potential improvement of credit score

Making regular, on-time payments towards your consolidation loan can have a positive impact on your credit score. It demonstrates responsible financial behaviour and can help rebuild your credit history over time.

Disadvantages of debt consolidation

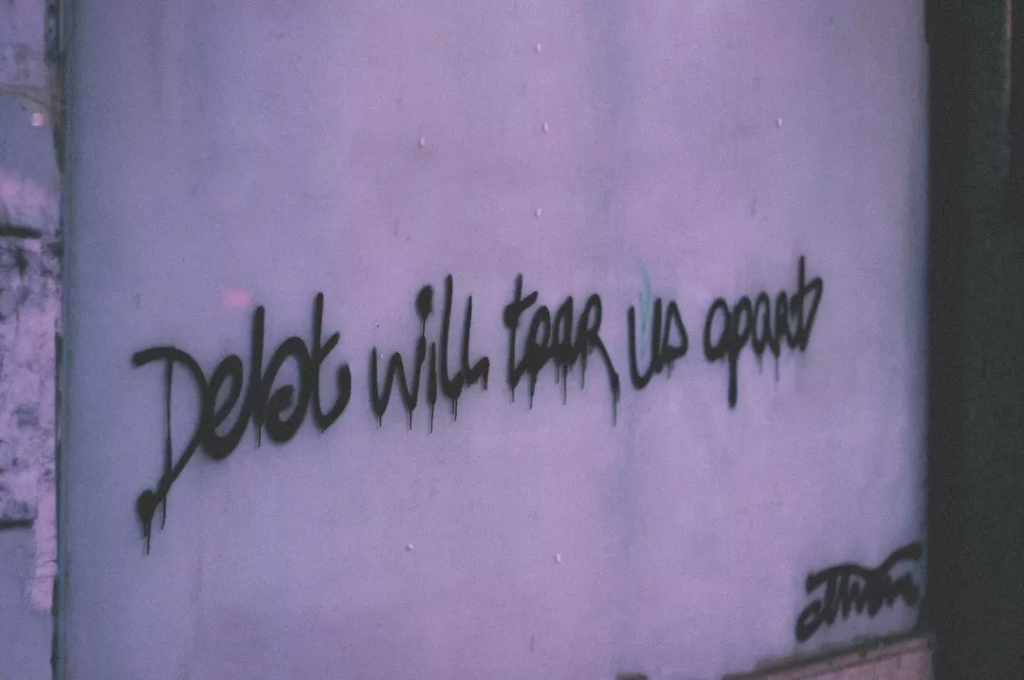

Risk of accruing more debt

Debt consolidation pays off your existing debts, but it does not eliminate the underlying issues that led to your debt accumulation. If you continue to spend irresponsibly or fail to address the root causes of your debt, you may end up accumulating more debt on top of the consolidation loan.

Potential for higher overall costs

While debt consolidation can lower your interest rate, it’s essential to consider the overall cost of the consolidation loan. Some loans may come with additional fees or a longer repayment term, resulting in higher overall costs compared to your original debts. Carefully review the terms and calculate the total repayment amount before committing to a consolidation loan.

Need for disciplined financial management

Debt consolidation is not a magic solution that automatically resolves your financial challenges. It requires disciplined financial management to avoid falling back into old habits. You must develop a budget, control spending, and make consistent payments towards your consolidation loan to achieve long-term financial stability.

Possible impact on credit score

While debt consolidation has the potential to improve your credit score, it can also have a temporary negative impact. When you apply for a consolidation loan, the lender will perform a credit inquiry, which may result in a slight decrease in your score. Additionally, if you close your existing accounts after consolidation, it can impact the length of your credit history, which is a factor in determining your credit score.

Is debt consolidation a good way to get out of debt?

When it comes to finding the right method to tackle your debt, debt consolidation is often considered a viable option. However, whether it’s the best choice for you depends on your unique financial circumstances.

Let’s explore whether debt consolidation is a good way to get out of debt and the factors to consider:

Factors to consider

Debt load

Assess the total amount of debt you have. Debt consolidation is generally more effective for moderate levels of debt. If you have an overwhelming amount of debt, you may need to explore other options such as debt settlement or bankruptcy.

Financial discipline

Debt consolidation requires financial discipline to avoid incurring new debt. Consider whether you have the discipline to make consistent payments towards the consolidation loan and avoid using credit cards or accumulating additional debt.

Interest rates

Evaluate the interest rates on your existing debts versus the potential interest rate on the consolidation loan. If you can secure a lower interest rate, debt consolidation can save you money on interest charges and help you pay off your debts faster.

Credit score

Examine your credit score and its impact on the interest rates available to you. If your credit score is low, you may have difficulty qualifying for favourable terms on a consolidation loan. In such cases, debt consolidation may not be the most suitable option.

Remember, debt consolidation is not a one-size-fits-all solution. It’s essential to evaluate your specific financial situation and goals before deciding if debt consolidation is the right path for you.

Is it hard to get approved for debt consolidation?

Getting approved for a debt consolidation loan depends on various factors, including your financial situation and creditworthiness. While it may not be overly difficult to obtain approval, there are certain considerations to keep in mind. Let’s explore whether it’s hard to get approved for debt consolidation and provide tips to improve your chances of approval:

Understanding the approval process

Debt consolidation lenders assess several factors when considering your application. These factors may include your credit score, income stability, debt-to-income ratio, employment history, and overall financial health. Lenders want to ensure that you have the ability to repay the consolidation loan.

Factors that lenders consider for approval

Credit score

Your credit score plays a significant role in the approval process. A higher credit score generally increases your chances of approval and helps you secure more favourable terms, such as lower interest rates. Lenders typically prefer borrowers with good or excellent credit scores.

Income and employment stability

Lenders want to ensure that you have a stable source of income to meet your monthly repayment obligations. Having a steady job and a consistent income stream can strengthen your application.

Debt-to-Income Ratio

Lenders assess your debt-to-income ratio, which compares your monthly debt payments to your monthly income. A lower debt-to-income ratio demonstrates your ability to manage your debt obligations effectively and increases the likelihood of approval.

Collateral

Secured debt consolidation loans require collateral, such as a home or other valuable assets. Lenders may consider the value of your collateral and its ability to cover the loan amount in case of default.

Tips to improve your chances of approval

Check your credit report

Obtain a copy of your credit report and review it for any errors or discrepancies. Dispute any inaccuracies and work on improving your credit score if needed.

Pay bills on time

Make consistent, on-time payments for all your existing debts and bills. Timely payments reflect positively on your credit history and demonstrate your financial responsibility.

Reduce debt

Prioritise reducing your existing debts to improve your debt-to-income ratio. Paying down debts can help lower your monthly obligations and increase your chances of approval.

Compare lenders

Research and compare different lenders to find the one that offers favourable terms and suits your needs. Consider factors such as interest rates, fees, repayment terms, and customer reviews.

While the approval process for debt consolidation loans may have some requirements, it’s not necessarily difficult to get approved. Taking proactive steps to improve your credit score, manage your debts responsibly, and demonstrate financial stability can significantly enhance your chances of securing approval.

When is debt consolidation not a good idea?

While debt consolidation can be a useful tool for managing debt, it may not be the best solution in every situation. There are certain circumstances in which debt consolidation may not be a good idea.

Insufficient income and financial stability

If you don’t have a stable income or struggle to meet your basic living expenses, taking on a consolidation loan may further strain your finances. In such cases, it’s important to focus on improving your financial stability before considering debt consolidation.

Chronic overspending and lack of budgeting

Debt consolidation is not a quick fix for chronic overspending or a lack of budgeting. If you continue to spend irresponsibly without addressing the underlying financial habits that led to your debt, consolidating your debts may only provide temporary relief and lead to a cycle of accumulating more debt.

High risk of default or bankruptcy

If you’re at a high risk of defaulting on your debts or contemplating bankruptcy, debt consolidation may not be the most appropriate solution. In these situations, it’s crucial to consult with a credit counsellor or a bankruptcy attorney to explore other debt relief options that better align with your circumstances.

Unfavourable loan terms

Debt consolidation loans come with varying terms, interest rates, and fees. If you’re unable to secure favourable terms or the interest rate on the consolidation loan is higher than your existing debts, it may not be financially beneficial to consolidate your debts.

Lack of commitment to financial discipline

Debt consolidation requires discipline and commitment to responsible financial management. If you’re not prepared to change your spending habits, create a budget, and stick to a debt repayment plan, debt consolidation may not provide a long-term solution.

Alternative debt relief options to consider

Debt Management Plan (DMP)

A DMP involves working with a credit counselling agency to negotiate lower interest rates and create a repayment plan. It can be an effective option if you’re struggling to manage your debts and need professional guidance.

Debt settlement

Debt settlement involves negotiating with creditors to reduce the overall amount you owe. This option is typically suitable for individuals facing significant financial hardship and unable to make regular payments.

Bankruptcy

Bankruptcy should be considered as a last resort. It provides legal protection and can help discharge or restructure debts. Consulting with a bankruptcy attorney is crucial to understand the implications and determine if it’s the right course of action for you.

DIY debt repayment

If your debts are manageable and you have the discipline to create a budget and pay off your debts systematically, a DIY debt repayment plan may be a viable option. Prioritise your debts based on interest rates or balances and allocate extra funds towards paying them off.

Carefully evaluate your financial situation, goals, and alternatives before deciding on debt consolidation. Sometimes, exploring other debt relief options may provide a more suitable solution for your specific circumstances.

Does consolidating loans hurt credit score?

Consolidating loans does not necessarily hurt your credit score. In fact, it can have both positive and negative effects, depending on how you handle the consolidation process and manage your debts moving forward.

Short-term impact on credit score

When you apply for a debt consolidation loan, the lender will likely perform a hard inquiry on your credit report. This inquiry can cause a small, temporary dip in your credit score. However, the impact is usually minimal and fades over time.

Debt utilisation ratio

Debt consolidation can positively impact your credit score by improving your debt utilisation ratio. This ratio compares your total credit card balances to your credit limits. By paying off credit card debts through consolidation, you lower your balances and potentially improve your credit score.

Payment history

Consistent, on-time payments towards your consolidation loan can have a positive impact on your credit score. Timely payments demonstrate responsible financial behaviour and contribute to a good payment history, which is a significant factor in determining your credit score.

Length of credit history

Debt consolidation may affect the length of your credit history. Closing old accounts after consolidating debts can shorten the average age of your credit accounts. However, keeping those accounts open and active can help maintain a longer credit history, which is beneficial for your credit score.

Credit mix

Debt consolidation can diversify your credit mix if you’re consolidating different types of debts, such as credit cards, personal loans, or student loans. A diverse credit mix can positively impact your credit score, as it demonstrates your ability to manage various types of credit responsibly.

Risk of accumulating more debt

While debt consolidation itself does not directly hurt your credit score, the risk of accumulating more debt can have a negative impact. If you don’t address the root causes of your debt and continue to overspend or miss payments, your credit score may suffer.

It’s important to note that responsible debt consolidation and diligent financial management are crucial to maintaining or improving your credit score. Make timely payments, avoid taking on additional debts, and monitor your credit report regularly to ensure accuracy.

If you’re concerned about the potential impact on your credit score, consider seeking advice from a credit counsellor or financial advisor. They can guide you on the best approach to debt consolidation and help you minimise any negative effects on your credit score.

How long does a debt consolidation stay on your credit?

When you undergo debt consolidation, the impact on your credit report and how long it stays on your credit history can vary.

Debt consolidation and credit reports

Debt consolidation itself does not have a specific entry on your credit report. Instead, the individual debts that you consolidate are updated to reflect their new status. For example, credit card accounts may show a balance of zero if they were paid off through consolidation.

Duration on credit report

The length of time that debt consolidation information appears on your credit report depends on the specific credit reporting agency’s policies. In general, the consolidated debts will remain on your credit report for a period of seven years from the date of the original delinquency or last activity.

Positive impact on credit score

Over time, debt consolidation can have a positive impact on your credit score if you consistently make on-time payments towards the consolidation loan. As you reduce your overall debt and demonstrate responsible repayment behaviour, your credit score may improve.

Rebuilding credit after debt consolidation

After debt consolidation, it’s important to focus on rebuilding your credit. Here are some steps to consider:

Maintain timely payments

Continue making all payments, including the consolidation loan, on time. Timely payments show your commitment to responsible financial management and help improve your credit score.

Avoid new debts

Resist the temptation to accumulate new debts or max out your credit cards. Use credit responsibly and keep your credit utilisation ratio low by maintaining a balance between your credit limits and outstanding balances.

Monitor your credit report

Regularly review your credit report to ensure accuracy and identify any discrepancies. Report any errors promptly to the credit reporting agencies.

Diversify credit mix

If appropriate for your financial situation, consider diversifying your credit mix by responsibly using different types of credit, such as credit cards or instalment loans. This can positively impact your credit score over time.

Patience and persistence

Rebuilding your credit after debt consolidation is a gradual process that requires patience and persistence. Consistently practising good credit habits and managing your finances responsibly will yield positive results over time.

Remember, the exact duration of debt consolidation on your credit report may vary based on reporting practices. It’s important to focus on the overall improvement of your credit health and use debt consolidation as a tool to help you achieve your financial goals.

Debt consolidation can be a valuable tool for managing your debts and improving your financial well-being. However, it’s essential to consider your unique circumstances, weigh the pros and cons, and explore alternative options if necessary. By making informed decisions and practising responsible financial habits, you can take control of your debt and work towards a brighter financial future.