How is debt to income ratio calculated?

Table of Contents

ToggleIf you’re wondering “How is debt to income ratio calculated?” then it’s actually a straightforward process. It’s really important to understand your debt to income ratio. Basically, it shows you how much debt you have compared to how much money you make. This helps you see if you’re doing well or not so well financially. Knowing this number can make a big difference in your financial future. If you have too much debt, it can cause a lot of problems for people.

In this blog post, we’re going to talk about something called a debt to income (DTI) ratio. If you want to take charge of your money situation, keep reading! We’ll explain what it means and how to calculate it.

What is debt to income ratio?

When we look at how well people are doing with their money, there’s an important thing to think about called the debt to income ratio. This tells us how much of a person’s earnings go towards paying off the money they owe. Basically, it helps us see if someone can handle their debt and pay it back properly based on how much money they make.

When interest rates and borrowing habits change in Australia, it’s really important for both people borrowing money and the banks lending it to understand the debt to income ratio. This ratio is a way to see if someone can handle the amount of debt they have and gives an overall picture of how well people in Australia can handle their money. It also affects how banks decide who to lend money to and how stable the country’s financial system is.

Factors affecting debt to income ratio?

In the past few years, Australia has seen its debt compared to income go up a lot. This is something worth looking into. There are many different things that are playing a part in this and making it a big worry.

- Increase in household consumption driven by steadily rising disposable income. Australians are increasingly spending on housing and other lifestyle expenses, which ultimately contributes to higher debt levels.

- Escalating property prices are encouraging Australian citizens to take out larger mortgages to fund their property purchases, significantly impacting their debt to income ratio.

- Low-interest rates have made borrowing more attractive, prompting households and businesses to readily acquire loans for various purposes.

- Changes in employment patterns and wage growth have a direct bearing on this aspect, as stagnant wage increases can lead to an undue burden of debt on individuals.

To deal with these factors that are adding to the problem, it’s important for people to take a proactive approach to learn about money and how to borrow responsibly. This will help protect their own financial stability and also the overall economy of the country.

How is debt to income ratio calculated?

Your debt to income ratio is a really important number that banks and other lenders use to see if you can pay back a loan or handle your money well. They figure it out by taking all the money you owe each month and dividing it by how much money you make each month before taxes. It’s shown as a percentage, and it tells you how good your finances are. If your ratio is low, that means you’re more likely to get a loan because it shows you’re not a big risk. Knowing this number helps Australians make smart choices about borrowing money, managing debt, and planning for the future.

When people show that they have a good balance between the money they owe and the money they earn, they can get loans with more favorable conditions. This helps them have a stable financial situation and enjoy the advantages that come with it.

What is the DTI limit?

Understanding mortgages and home loans can feel overwhelming, especially when you’re trying to figure out how lenders decide if you can pay them back. One important thing they look at is the Debt-to-Income (DTI) limit, which is a fancy way of saying how much of your income goes towards paying debts.

The DTI limit is not set by strict rules or specific numbers. Instead, each lender decides how much debt a person can have compared to their income, depending on how much risk they’re willing to take. They figure this out by looking at how much of a person’s income goes towards paying off debts each month. This is important because it helps lenders see how financially stable someone is and makes sure they’re being responsible when lending money.

When you’re looking for your dream home or thinking about investing in property, it’s important to know about the DTI limit in Australia and understand your financial situation. This will help you make smart decisions when exploring your mortgage choices in the competitive market.

Implications of a high debt to income ratio?

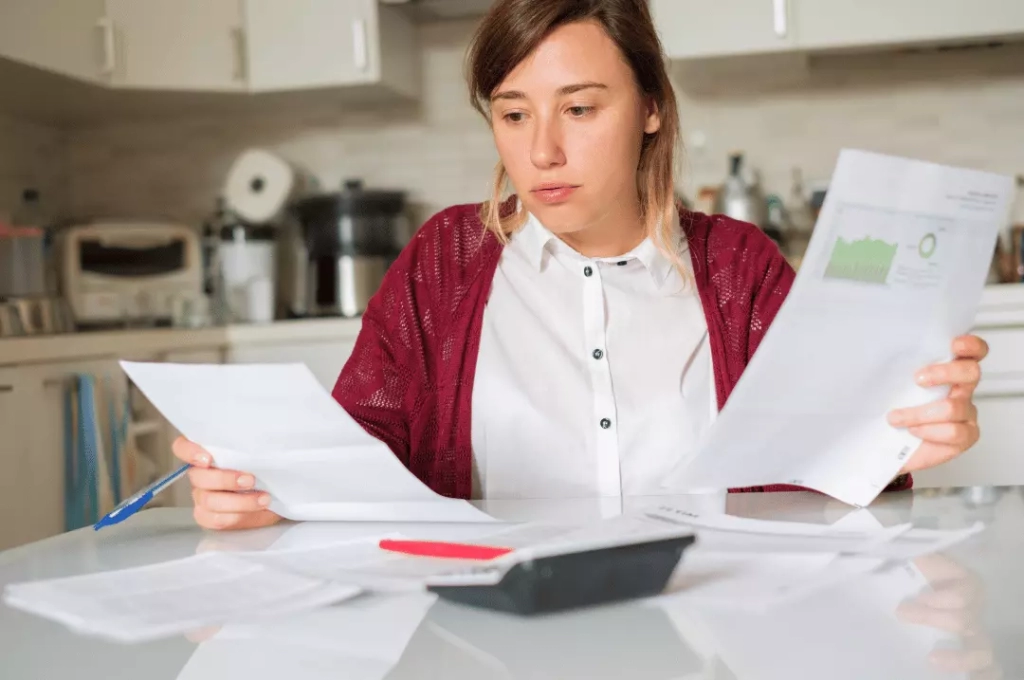

The high debt to income ratio is becoming a big problem that affects both people and the overall economy. It shows that Australian households are having a hard time managing their money because they have a lot of debt compared to their income. The situation is even worse than in many other rich countries. This puts the country’s economic stability at risk because it’s like walking on a tightrope with your finances. When people owe a lot of money, they can’t spend as much, they feel more stressed about their finances, and they might not be able to pay back what they owe.

As jobs and pay aren’t growing much, it’s really important for government people and banks to come up with plans to help families who are struggling. They need to find ways to make the economy strong and stable in Australia for the future.

Tips for lowering your debt to income ratio?

Lowering your debt to income ratio can really help your financial situation and make it easier for you to get loans or a mortgage.

- Focus on increasing your income while simultaneously reducing your current level of debt.

- Consider acquiring additional skills, negotiating a salary rise or pursuing freelance work in your field of expertise to boost your income.

- Prioritise paying off high-interest debts, such as credit cards, first.

- Consolidating your debt through a personal loan, as this can potentially lower your interest rate and simplify your repayments.

- Adopting a disciplined budgeting approach by cutting non-essential expenses and increasing your savings can further enable you to achieve a healthier debt to income ratio, ultimately paving the way for a more stable and prosperous future.

What is a good ratio of debt to income?

Managing your money and keeping a good balance between what you owe and what you earn can sometimes be a bit scary. But it’s important to understand what a good debt-to-income ratio means so you can make smart financial choices and stay stable in the long run. Lenders and banks often use a rule that says your debt shouldn’t be more than 35% of your income. This means that only 35% of the money you make each month should go towards paying off things like your house, car, and credit cards. Following this rule helps Australians handle their money well, avoid getting overwhelmed by debt, and still have enough left over to enjoy life and save for the future.

If you keep an eye out and manage your money wisely, Australians can find a good balance between using credit when it makes sense and building a safe and successful financial future.

Best strategies for managing your finances and reducing debt

To handle your money well and decrease debt, you need to use different methods and stick to them consistently for a long time.

- Creating and sticking to a comprehensive budget is crucial for taking control of your expenses and identifying areas wherein savings can be made.

- Regularly reviewing your budget also helps to accommodate any changes in your financial circumstances.

- Focusing on paying off high-interest debts as fast as possible will significantly reduce the overall amount you owe.

- Incorporating smart saving habits, such as setting up an emergency fund, can prevent you from falling into the pitfalls of further debt.

- Utilising financial tools and professional advice will give you a holistic view of your financial situation, empowering you to make financially responsible decisions.

If you use these strategies regularly, you can handle your money better and lower the amount of money you owe. This will help you have a safer and more successful financial future.

The debt to income ratio is an important number that shows how healthy your finances are. It helps lenders decide if they should give you a loan or not, and it can also give you an idea of how well you’re doing with your money. If your debt to income ratio is high, it’s not great, but you can still handle it by making a budget, paying more than the minimum on your debts, and finding ways to earn more money. By reducing your debts and keeping an eye on your debt to income ratio over time, you can get closer to the ideal number recommended by experts. Managing your money isn’t always easy, but if you have a plan like cutting down on your expenses, saving for emergencies, and paying your debts on time, you can do it.

Ultimately, knowing how to handle your money well can bring you advantages in the long run without much trouble or expense. If you need assistance with managing or reducing debt in Australia, contact us today. Our team of experts is here and ready to help you!