When should I start planning for retirement

Table of Contents

ToggleIn the land of kangaroos and the Great Barrier Reef, retirement planning often takes a backseat to the hustle and bustle of everyday life. However, as Australians, we all dream of a comfortable and fulfilling retirement, whether it’s exploring the vast outback or indulging in leisurely strolls along Bondi Beach.

Picture this: you’re 65, basking in the golden rays of retirement, free from the daily grind of work. You’ve got the time, the energy, and the financial freedom to pursue your passions, travel the world, or simply spend quality time with loved ones. Sounds idyllic, doesn’t it?

But how do you turn this retirement dream into a reality? The answer lies in the power of planning, and the sooner you start, the better. The magic of compounding, the eighth wonder of the world according to Albert Einstein, works wonders for your retirement savings. The longer your money has to grow, the more it will compound, generating a snowball effect that can significantly boost your retirement nest egg.

On the other hand, delaying retirement planning can have dire consequences. A study by the Association of Superannuation Funds of Australia (ASFA) revealed that almost half of Australians are concerned about their retirement savings. This anxiety stems from the realisation that they’ve left it too late to make significant contributions to their retirement fund.

So, when should you start planning for retirement? The answer is simple: the earlier, the better. Ideally, you should start in your 20s, even if it’s just a small contribution each month. Even these modest contributions will have a significant impact over time, thanks to the magic of compounding.

Of course, it’s never too late to start planning for retirement. Even if you’re nearing retirement age, every dollar you can save will make a difference. The key is to start now and take action towards securing your financial future.

In this blog post, we’ll explore the topic of claiming a deduction for personal super contributions and help you determine whether it’s the right choice for you.

The Importance of Early Retirement Planning

In the land of mates and barbie, retirement planning is often seen as a distant prospect, something to worry about when we’re older and wiser. But the truth is, the earlier you start planning for retirement, the better off you’ll be.

Why is early retirement planning so important? Let’s break it down:

The Power of Compound Interest

Imagine your retirement savings are like a snowball rolling down a hill. The longer the hill, the bigger the snowball. The same principle applies to compounding interest. The sooner you start saving, the more time your money has to grow, and the more significant the impact of compounding will be.

Reduced Financial Burden

Starting early allows you to spread out your retirement savings contributions over a longer period, making them more manageable. This is especially helpful for younger Australians who may be juggling other expenses like student loans or mortgages.

Flexibility and Peace of Mind

Early planning gives you more flexibility to adjust your savings goals and strategies as your life circumstances change. It also provides peace of mind knowing that you’re actively working towards your retirement dreams.

Here’s a real-life example to illustrate the power of early retirement planning:

Let’s say you start saving for retirement at age 25 and contribute $100 per month. By the time you reach retirement age at 65, assuming an average annual return of 7%, your savings will have grown to a staggering $280,000.

Now, compare that to someone who starts saving the same amount at age 45. Their savings would only grow to around $100,000 by retirement age.

The difference is clear: the earlier you start, the more your money has time to grow, and the more comfortable your retirement will be.

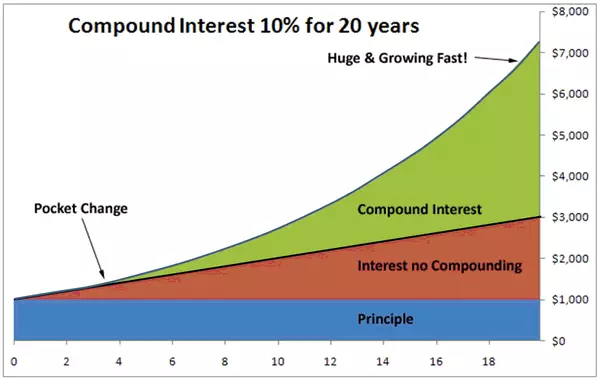

Compound Interest Diagram:

In this diagram, the horizontal axis represents time, and the vertical axis represents the value of your investment. The curve shows how your investment grows over time due to compound interest. As you can see, the earlier you start investing, the steeper the curve and the larger your investment will grow.

So, don’t let retirement be a distant dream. Take charge of your financial future today and start planning for the retirement you deserve.

Ideal Starting Points for Retirement Planning

Navigating the world of retirement planning can seem daunting, especially for young Australians who are just starting their careers. But the good news is, it’s never too early to start planning for your future. In fact, the earlier you begin, the more time your money has to grow and the more comfortable your retirement will be.

The ideal starting point for retirement planning depends on your individual circumstances, such as your age, income, and financial goals. However, as a general rule of thumb, it’s a good idea to start thinking about retirement in your 20s or even earlier.

Here are some specific recommendations for different age groups:

20s

- Start saving even small amounts regularly, even if it’s just $20 or $50 per month.

- Take advantage of employer-sponsored retirement plans, such as superannuation in Australia.

30s

- Increase your retirement contributions as your income grows.

- Review your investment strategy and make adjustments as needed.

- Consider getting professional financial advice if you need personalised guidance.

40s

- Ramp up your retirement savings efforts, aiming to save at least 15% or more of your income.

- Review your retirement goals and make sure they align with your current lifestyle and aspirations.

- Start thinking about how you’ll fund your retirement healthcare expenses.

50s

- Make catch-up contributions to your retirement accounts if you’re eligible.

- Begin converting your retirement savings into income streams, such as annuities or withdrawals from your superannuation fund.

- Start planning for your long-term care needs.

60s

- Finalise your retirement budget and make sure your savings can sustain your desired lifestyle.

- Review your healthcare coverage and make any necessary adjustments.

- Enjoy your retirement!

Remember, retirement planning is a marathon, not a sprint. It’s about taking consistent steps over time to secure your financial future. By starting early and making regular contributions, you’ll be well on your way to a comfortable and fulfilling retirement.

Factors to Consider When Determining Your Retirement Age

As you approach the golden years of retirement, one of the key decisions you’ll face is determining when to hang up your work boots and embrace the joys of leisure. While there’s no one-size-fits-all answer, several factors play a crucial role in determining your ideal retirement age.

Financial Readiness

Your financial situation is perhaps the most significant factor influencing your retirement decision. Have you accumulated enough savings to support your desired lifestyle throughout your retirement years? Consider factors like your anticipated living expenses, healthcare costs, and potential travel plans.

Personal Goals and Aspirations

Retirement is an opportunity to pursue your passions and interests. Do you dream of traveling the world, volunteering for causes you care about, or spending quality time with loved ones? Reflect on your personal goals and aspirations to determine if your financial situation aligns with your desired retirement lifestyle.

Health and Well-being

Your physical and mental health play a significant role in enjoying a fulfilling retirement. Consider your current health status and any potential age-related health concerns. If you anticipate needing more time for self-care or managing health conditions, it may be wise to delay retirement.

Employment Satisfaction and Career Trajectory

If you still find fulfillment and satisfaction in your work, you may choose to continue working past the traditional retirement age. On the other hand, if you’re feeling burnt out or unchallenged, an earlier retirement could be a welcome change.

Social Connections and Engagement

Retirement offers an opportunity to strengthen social bonds and engage with your community. Consider your current social network and whether you have plans to stay connected with colleagues, friends, and family post-retirement.

Government Regulations and Entitlements

In Australia, the eligibility age for various government benefits, such as the Age Pension, gradually increases from 65 to 67 between 2023 and 2029. Considering these age requirements can help you plan your retirement finances accordingly.

Spouse or Partner's Retirement Plans

If you’re married or in a long-term partnership, it’s crucial to coordinate your retirement plans with your partner. Discuss your respective financial situations, retirement goals, and desired retirement lifestyles to ensure alignment.

Strategies for Effective Retirement Planning

Charting your course towards a secure and fulfilling retirement requires a strategic approach that encompasses various aspects of your financial and personal well-being. Here are some key strategies to consider:

Set Clear Retirement Goals and Objectives

Envision the lifestyle you want to enjoy in retirement. Consider your desired living arrangements, travel plans, hobbies, and potential healthcare needs. Having clear goals will guide your savings and investment decisions.

Maximise Retirement Savings Contributions

The earlier you start saving, the more time your money has to grow through compound interest. Contribute regularly to employer-sponsored retirement plans like superannuation.

Diversify Your Investment Portfolio

Don’t put all your eggs in one basket. Allocate your investments across different asset classes, such as shares, bonds, and real estate, to balance risk and potential returns. Seek professional advice if needed.

Review Your Retirement Plan Regularly

As your circumstances change, revisit your retirement plan to ensure it aligns with your current financial situation, goals, and risk tolerance. Adjust your contributions, investment strategy, and retirement age as needed.

Consider Catch-up Contributions

If you’re older or nearing retirement, you may be eligible for catch-up contributions to your retirement accounts. These higher contribution limits can help you boost your savings and catch up with those who started earlier.

Explore Tax-Advantageous Options

Take advantage of tax-deferred and tax-free retirement savings accounts, such as superannuation in Australia, to minimise your tax burden and maximise your savings potential.

Plan for Healthcare Costs

Healthcare expenses can be a significant factor in retirement planning. Research your healthcare options, including Medicare coverage and private health insurance, to understand your potential costs.

Seek Professional Guidance

Consulting a qualified financial advisor can provide valuable insights and personalised strategies tailored to your specific financial situation, goals, and risk tolerance.

Stay Informed about Government Regulations

Keep abreast of changes in government regulations and entitlements related to retirement, such as eligibility rules for the Age Pension or superannuation withdrawal options.

Plan for Long-Term Care Needs

Consider long-term care insurance or other strategies to address potential long-term care expenses, especially as you age.

Remember, retirement planning is an ongoing process that requires discipline, flexibility, and a proactive approach. By implementing these strategies and seeking guidance when needed, you can chart a course towards a secure and fulfilling retirement.

As you navigate the journey of retirement planning, consider seeking professional guidance from a qualified financial advisor. Their expertise, tailored strategies, and ongoing support can help you make informed decisions, navigate complex financial matters, and achieve your retirement goals with confidence.

Remember, retirement is not just about financial planning; it’s about designing a life that aligns with your passions, aspirations, and values. Embrace the planning process, make informed decisions, and take control of your financial future. A secure and fulfilling retirement is within your reach.