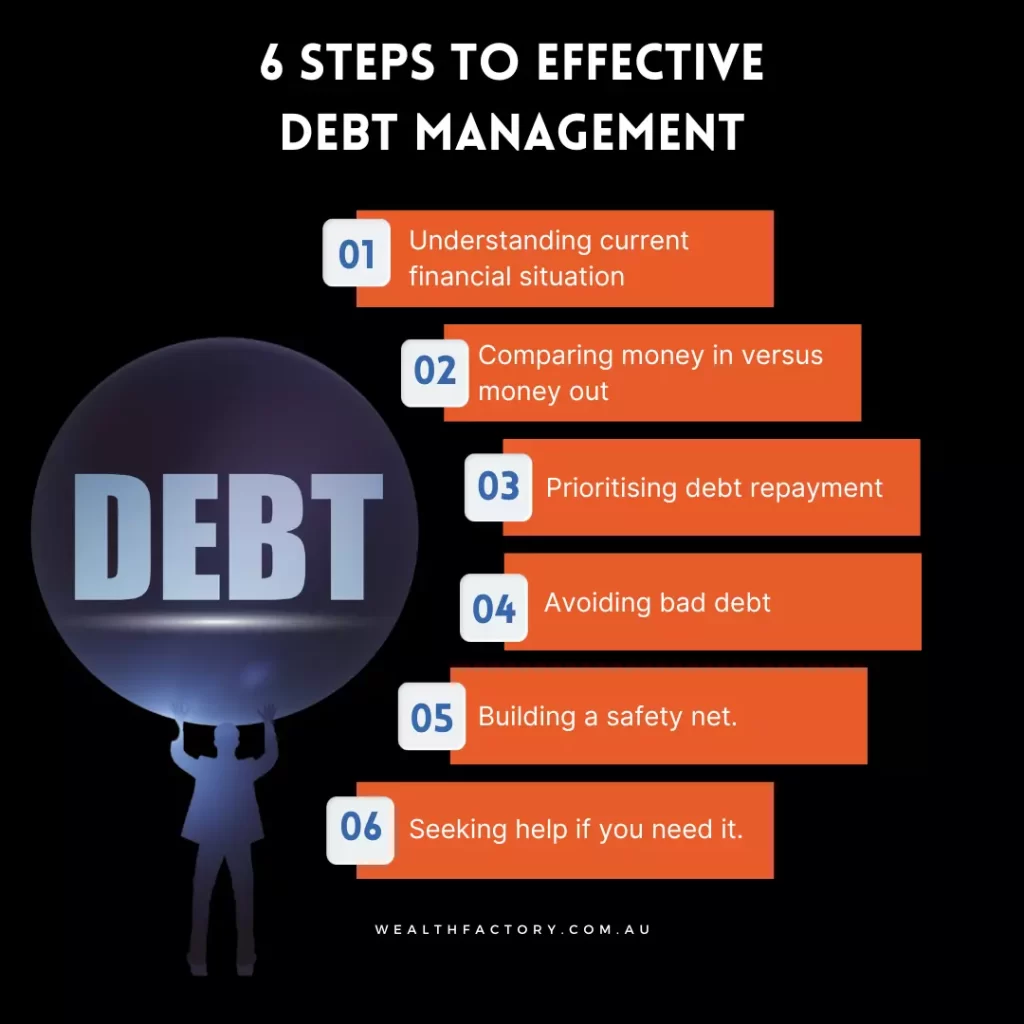

Six steps to effective debt management

Table of Contents

ToggleAustralian households are among the most indebted in the world, and it is crucial to take action now to avoid losing everything. This article provides six key steps for effective debt management that will help you quickly and efficiently get your cash flow back on track.

Your Guide Towards Effective Debt Management

According to a 2020 report by the Organisation for Economic Co-operation and Development (OECD), Australian households are the fifth most indebted in the world. The report showed that the average Australian family with a disposable income of $100,000 has about $203,000 worth of debt. The cost of living in Australia is rising, and this trend is expected to continue in the future. With rising rates and inflation affecting all areas of society, from food prices to healthcare bills, it is not surprising that many people are feeling the financial strain without taking any steps to alleviate it.

Given the large number of individuals experiencing debt-related stress, it is not surprising that there are 1.5 million Australian households currently facing financial difficulties due to mortgage stress. A combination of home loans, credit cards, car loans, and personal loans contribute to this financial pressure. Having so much debt can also affect your debt-to-income ratio. While dealing with debt can be overwhelming, it is possible to regain financial stability through commitment and a well-crafted debt management plan.

1. Understanding current financial situation

To effectively manage your debt, it is essential to reduce it. However, before you can take steps to decrease your debt, it is important to have a clear understanding of your current financial situation. This can be challenging, especially if you are struggling to make ends meet. The initial step in addressing your debt is to determine the exact amount you owe. To do this, create a list of all your debts and their monthly payments, then add them up to get the total.

2. Comparing money in versus money out

To determine how much debt you can afford, calculate your monthly income from salary and any investment earnings such as stocks and bonds. Next, subtract essential living expenses like housing, food, utilities, and transportation. This will give you an idea of how much money you have available for non-essential expenses. The government offers free budgeting tools on the Moneysmart website to help you manage your spending and avoid going into debt.

3. Prioritising debt repayment

High interest rates on credit cards make them one of the most harmful debts to have. To minimise this risk, try to pay off this debt in full each month if possible, including personal loans and car loans. If this is not an option, consider requesting financial hardship assistance from your service provider to reduce the burden on your household finances, particularly when other critical expenses like mortgage payments and council rates need attention. It is better to be proactive and work with your providers to come up with a payment plan that best fits your financial situation.

Consult with a knowledgeable financial advisor to assist with organising your financial arrangements. If possible, reach out to your financial advisor before taking on loans or other costly debts, such as mortgages, to develop a manageable payment plan and avoid high-interest rate bills.

4. Avoiding bad debt

When managing your debts, avoid taking on more debt to pay off your loans. If borrowing money can help you build wealth or generate income, such as through a mortgage or education loan, go for it. But avoid taking on “bad” debts for things like vacations or entertainment, which can end up costing you more than the original amount owed. A good rule of thumb is to only borrow for things that will improve your financial position.

5. Building a safety net

Once you have paid off your debt, you should use any extra income to establish an emergency savings fund. As a homeowner, one option to save for emergencies is to get an offset facility on your mortgage, which will let you pay off more of the principal each month while reducing interest and having cash available for unexpected expenses.

6. Seeking help if you need it

Being in debt can be overwhelming and feel like there is no end. If you need help with your debt management plan, consider seeking advice from a financial adviser. It’s important to reach out for professional help when needed.