How to Choose a Financial Adviser – A Comprehensive Guide

Table of Contents

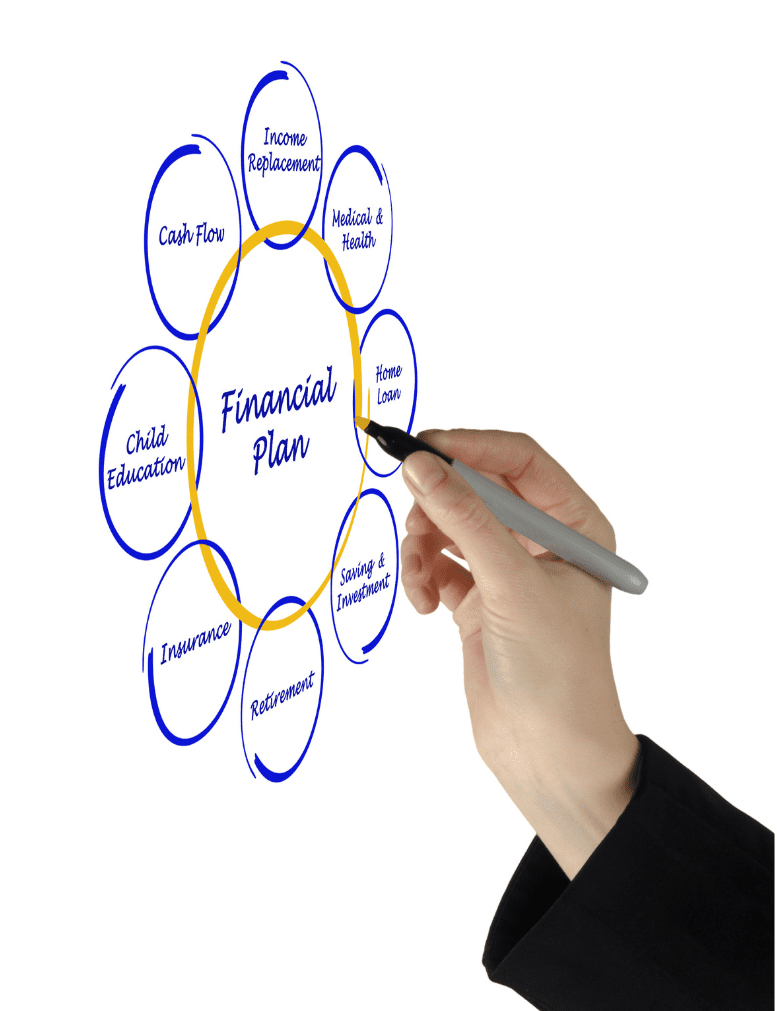

ToggleSo, you’re wondering how to choose a financial adviser? When it comes to managing your finances and planning for the future, a financial advisor can be an invaluable partner. However, choosing the right financial advisor is a critical decision that requires careful consideration. In this guide, we’ll walk you through the steps to choose a financial advisor who meets your needs and aligns with your financial goals.

Determine Your Goals and Needs

Before you start looking and wondering how to choose a financial adviser, it’s essential to have a clear understanding of your financial goals and needs. Consider what specific financial objectives you want to achieve, such as retirement planning, wealth accumulation, or debt management. Having a well-defined set of goals will help you narrow down your search and find an adviser who specializes in the areas that matter most to you.

Understand the Types of Specialist Financial Advisers

Financial advisers come in various forms, each with its own set of services and expertise. The key types of financial advisers include:

– Financial Planners: These professionals provide comprehensive financial planning services, including retirement planning, investment strategies, and risk management.

– Investment Advisers: If you primarily need help with investment decisions, an investment adviser can assist you in building and managing your investment portfolio.

– Wealth Managers: Wealth managers offer a holistic approach to managing your financial affairs, often catering to high-net-worth individuals.

– Estate Planners: Estate planners focus on estate and legacy planning, helping you protect and distribute your assets according to your wishes.

Understanding the different types of advisers will help you pinpoint the one that aligns with your specific needs and make sure you know how to choose a financial adviser.

Check Qualifications and Credentials

Once you’ve identified your financial goals and the type of adviser you require, it’s crucial to verify the qualifications and credentials of potential advisers. Look for professionals who hold recognized certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA). These designations indicate a commitment to ethical and professional standards in the financial industry. Additionally, check if the adviser is registered with relevant regulatory authorities, which adds an extra layer of protection for consumers.

Assess Reputation and Track Record

A financial adviser’s reputation and track record are strong indicators of their competence and trustworthiness. To evaluate an adviser’s reputation, you can:

– Read Online Reviews: Search for reviews and testimonials from current and past clients to gauge their satisfaction levels.

– Ask for Referrals: Seek recommendations from friends, family members, or colleagues who have worked with financial advisers.

– Check Disciplinary History: Verify if the adviser has any disciplinary actions or complaints filed against them with regulatory authorities.

A reputable adviser will have a history of delivering quality service and achieving positive results for their clients.

Understand Fee Structure

Financial advisers charge fees for their services, and it’s crucial to understand how they are compensated. Common fee structures include:

– Flat Fee: Advisers charge a flat fee based on a amount of work required, or the service offering chosen. The assets under management do not directly impact the advice fees.

– Percentage-Based: Advisers charge a fee based on a percentage of your assets under management (AUM) or an hourly rate. This fee structure is often considered transparent and aligns the adviser’s interests with yours.

– Hybrid Model: Hybrid advisers may charge a combination of fixed and percentage fee.

Make sure you are comfortable with the fee structure and that it aligns with your financial goals. Be sure to ask for a breakdown of all potential costs associated with their services is a key aspect on how to choose a financial adviser.

Enquire About Services and Approach

During your initial meetings with potential advisers, don’t hesitate to ask questions about their services and approach. Consider asking:

– Investment Philosophy: What is their investment philosophy, and how does it align with your risk tolerance and goals?

– Communication: How often will you meet or communicate with the adviser? Will they proactively update you on your financial progress?

– Client-Centric Approach: Are they genuinely interested in understanding your financial situation and tailoring their recommendations to your unique needs?

– Financial Planning Process: Can they provide a clear outline of their financial planning process and the steps they will take to help you achieve your goals?

Understanding the adviser’s approach and the services they offer will help you determine if they are the right fit for you.

Compare Multiple Advisers

It’s advisable to meet and compare multiple financial advisers before making a decision. This allows you to evaluate different perspectives, fee structures, and approaches. By interviewing multiple advisers, you can make an informed choice that aligns with your financial objectives. Choosing the first adviser, the nearest, or perhaps the adviser that bought our your past adviser is a potential mistake when looking how to choose a financial adviser.

Conclusion – how to choose a financial adviser

Choosing a financial adviser is a significant decision that can profoundly impact your financial future. By following these steps and conducting thorough research, you can find an adviser who not only meets your needs but also aligns with your financial goals and values. Remember that the relationship with your adviser should be built on trust and open communication, ensuring a successful partnership in achieving your financial aspirations. Is there something else we missed in how to choose a financial adviser? Let us know.

Sources – How to choose a financial adviser:

– Moneysmart.gov.au – Choosing a financial adviser

– Forbes – How To Choose A Financial Advisor

– Australian Super – 5 things to consider when choosing a financial adviser