Can a US recession be a good thing?

Table of Contents

ToggleUS recession

The hot topic at the moment seems to be about the US recession and whether it will avoid it or go into it. But we are in Australia, so should we care? Well, unfortunately our market sentiments are largely connected, so if the US sneezes, we catch a cold. If the US market drops overnight, the Australian share market is likely to do the same.

So how did we get to this point in the economy? Consumer spending on goods in particular, but also services, has been a bit of a spending boom post COVID. If you have been trying to buy nearly anything over the last year or so, prices have risen, supply has dropped (other supply chain issues impacted this as well) and demand is high.

No one enjoys a recession. It’s a time when businesses suffer, jobs are lost, and the economy seems to be in a downward spiral. But could there be a silver lining to all of this? No one ever wants to see their country go through a recession, but sometimes it can be just what the doctor ordered. A good reset can help get things back on track and moving in the right direction. Some experts believe that a recession can be good for the economy – as long as it’s followed by a reset.

What is a recession and how does it happen?

A recession is a general downturn in economic activity. It is typically defined as two consecutive quarters of negative economic growth, as measured by a country’s gross domestic product (GDP). While recessions are often associated with falling stock prices, rising unemployment, and other negative economic indicators.

It is visible in industrial production, employment, real income and other indicators. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough. Between these turning points there is a period of declining economic activity.

Recessions are generally characterized by falling prices, low levels of investment and rising unemployment. Excessive debt accumulation can also lead to a financial crisis and to recessions. Government policies can be used to help stabilize the economy during a recession. For example, Keynesian economics recommends increasing government spending and expanding social welfare programs during a recession.

Can a recession be good for the economy?

There are two reasons as to why a recession can be good for the economy:

Recessions can help to reduce inflation

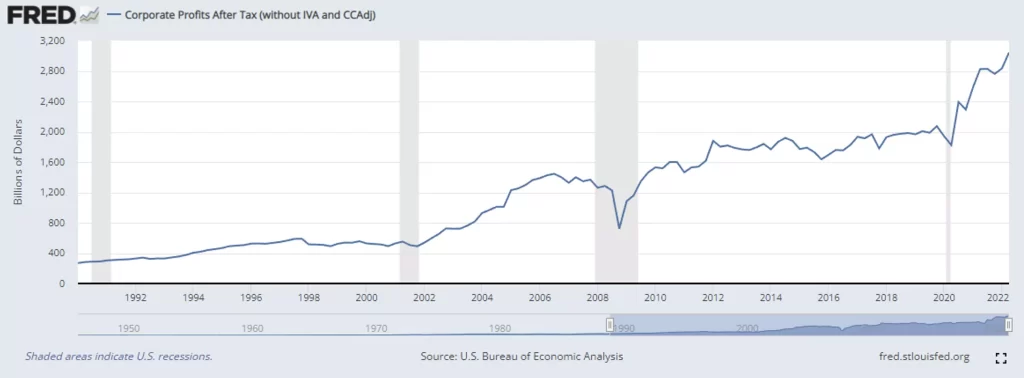

When the economy is booming, prices for goods and services often rise very quickly. This can erode people’s purchasing power and make it difficult to afford necessities. But when a recession hits and demand drops, prices usually fall as well, therefore reducing inflation. This gives people a chance to catch up on their bills and save money for the future.

Recessions prompt economic reforms

For instance, after the dot-com bubble burst in 2001, many companies were forced to re-evaluate their business models and become more efficient. As a result, the overall economy became stronger and more resilient. While it’s admittedly never fun to go through a recession, there may be some silver lining to the dark cloud.

What are some of the benefits of a recession?

While a recession may not sound like something to be excited about, there are actually some benefits that can come from it.

- A recession can help to clean out the economy and get rid of weak businesses that are struggling to survive. This can be good for the overall economy in the long run, as it allows stronger businesses to take their place.

- A recession can help to reduce inflationary pressures. When demand is down and businesses are struggling, prices tend to fall as well. This can be helpful for consumers who are looking to get more bang for their buck.

- A recession can often lead to lower interest rates. When the economy is struggling, the Federal Reserve will typically lower interest rates in an effort to stimulate growth. This can be beneficial for borrowers who are looking to get a better rate on their loans. While a recession can certainly be disruptive, there are some positive aspects that can come from it as well.

How can you protect yourself from the negative effects of a recession?

A recession is when the economy slows down for at least six months. This can lead to negative effects such as job loss, pay cuts, and increased debt. So how can you protect yourself from a recession?

- Make sure you have an emergency fund saved up. This will help you cover unexpected expenses if you lose your job or have a pay cut.

- Try to reduce your debt. This will make it easier to manage your finances if you experience a decrease in income.

- Diversify your portfolio and have a mix of investments. This way, if one asset class takes a hit, you’ve got others that can cushion the blow.

- Have some cash on hand in case you need to take advantage of opportunities that pop up during a recession, as the market may well be on sale at some stage and a buying opportunity.

- Remember that recessionary periods don’t last forever. So while it’s important to be prudent during tough times, don’t forget to keep your long-term goals in mind.

By following these tips, you can weather any recession and come out ahead.

How to make the most of a recession

A recession can be a tough time for some, but there are still ways to make the most of it. One silver lining of a recession is that it provides buying opportunities. With businesses struggling and people tightening their belts, many items can be had at a discount. However, it’s important to be smart about what you buy. Look for items that are high quality and will last long into the future.

Another way to make the best of a recession is to use it as an opportunity to get your finances in order. This is a good time to reassess your budget and find areas where you can cut back. It’s also a good time to start saving for the future.

By taking these steps now, you’ll be in a much better position when the recession finally comes to an end.

What happens if the US avoids a recession?

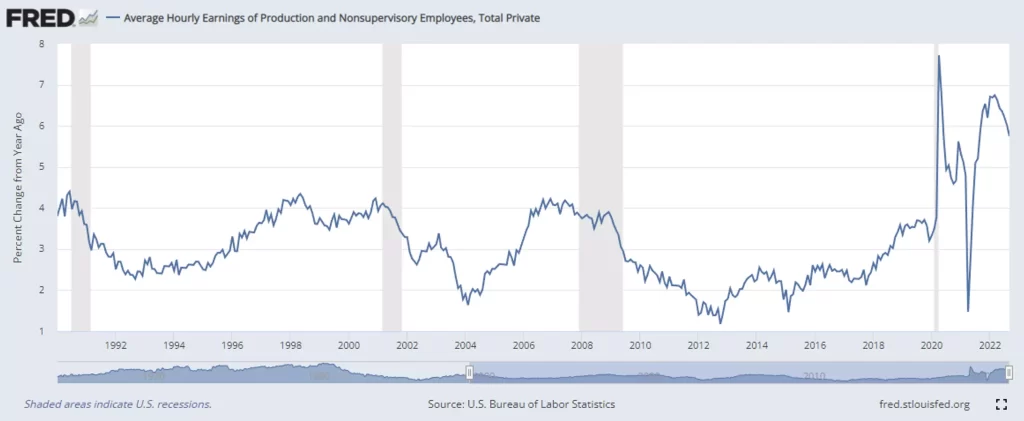

It’s a well-known fact that a recession tends to be followed by a period of lower inflation. In fact, it’s often one of the key indicators that a recession has ended. But what causes this to happen? There are a few different theories out there, but the most likely explanation is that during a recession, people and businesses spend less money. This reduction in demand helps to push down prices, which leads to lower inflation. Of course, this isn’t always the case – there have been periods of falling inflation without a recession – but it’s generally true that if you want to see lower inflation, you’ll need to see a recession first.

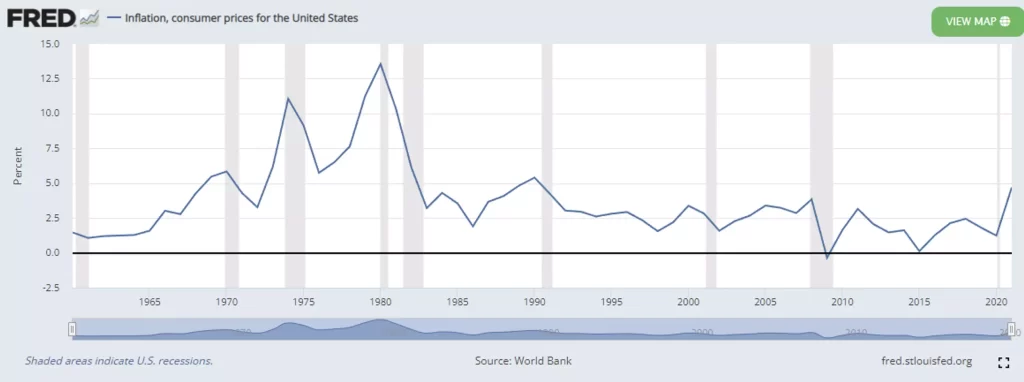

Historically things have not gone well when the federal reserve attempts to avoid a recession, as evidenced by “The Great Inflation” of 1965-1982.

The Great Inflation was a macroeconomic event that lasted from 1965 to 1982, led by economists to rethink central bank policies, and caused by Federal Reserve policies that allowed for an excessive growth in the money supply. The origins of the Great Inflation were motivated by Keynesian stabilization policy in pursuit of lower unemployment rates, which was believed to be achievable through modestly higher inflation rates.

The Federal Reserve accommodated large and rising fiscal imbalances during the Great Inflation, which accelerated the expansion of the money supply and raised overall prices without reducing unemployment. Economist Athanasios Orphanides has shown that policymakers were likely underestimating the inflationary effects of their policies.

Federal Reserve officials were well aware of the dual mandate that required monetary policy to be calibrated so that it delivered full employment and price stability. Nevertheless, the employment half of the mandate appears to have had the upper hand when full employment and inflation came into conflict.

By 1979, Paul Volcker became chairman of the Federal Reserve Board with a mission to reduce inflation rates by controlling reserve growth rate more stringently than before. This meant higher interest rates & slower economic activity (us recessions in 1980 & 1981), but eventually led to reduced joblessness & stable growth.

Two key lessons from the Great Inflation era remain relevant for the Federal Reserve today:

- First, price stability is paramountfor a strong and growing economy. The Great Inflation showed that tolerating high levels of inflation in an effort to stimulate the economy would ultimately prove detrimental.

- Second, the public must be confident in the Fed’s ability to lessen inflationary pressures—both now and in the future (Lopez, 2012).

Bottomline

Is a recession good or bad? It depends on how you look at it. From one perspective, recessions are natural events that happen in response to imbalances in the economy and can be beneficial in the long run. On the other hand, recessions can cause hardship for individuals and businesses alike.

If you’re worried about how a recession may affect your personal finances, get in touch with me to discuss your options. No matter what the future holds, we can work together to make sure you come out ahead.