What are exchange traded funds?

Have you ever heard of Exchange Traded Funds (ETFs)? You might have some but not know what they are. As investors, we are always looking for ways to grow our portfolio and protect our savings. One way to do this is by investing in exchange traded funds (ETFs).

What are retirement income streams?

Everyone's idea of retirement is different. For some, it means travelling the world and never having to work again. However you choose to spend your retirement, one thing is for sure: you'll need a reliable stream of income to make it happen.

How do I apply for an age pension?

For those of us who have worked hard our entire lives, receiving an age pension can be a bit of a shock. It doesn't seem fair that after contributing so much to society, we are now considered charity cases. Thankfully, the application process for age pensions in Australia is straightforward, and there are plenty of resources available to help you through it.

Six steps to effective debt management

Australian households are among the most indebted in the world, and it is crucial to take action now to avoid losing everything. This article provides six key steps for effective debt management that will help you quickly and efficiently get your cash flow back on track.

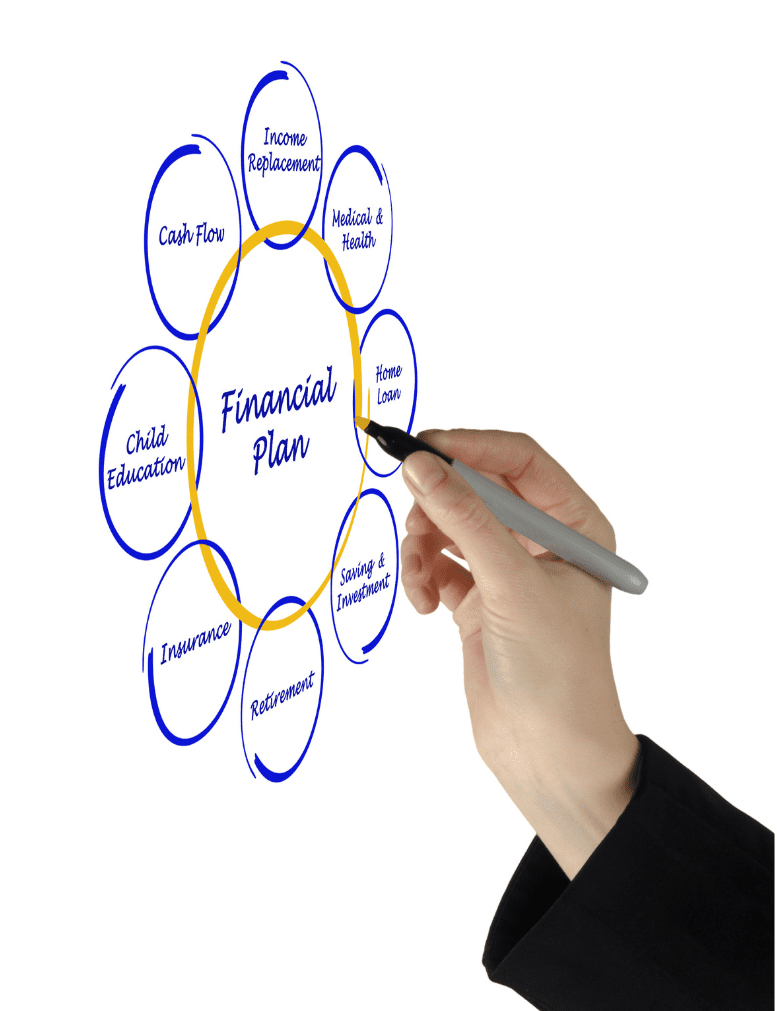

What good is a financial plan without a regular review

When it comes to financial planning, many people think that they are done once they have put together a plan. However, this could not be further from the truth! A good financial plan is one that is regularly reviewed and updated.

How to stop living paycheck to paycheck?

The article explains that living paycheck to paycheck is not a desirable situation, but rather a financial emergency. It provides advice on how to break the cycle of constantly needing to rely on each paycheck to get by, through making better financial decisions and getting back on track with one's expenses.

Responsibilities of the executor of a will

If you're considering taking on the role of an executor for a will, this article is a must-read. It outlines the responsibilities of the executor of a will and helps you understand what to consider before taking on such an important role.

Do you need income protection insurance?

Many people think that their income is safe until they lose their job. But what would you do if you lost your income tomorrow? Protect yourself with Wealth Factory’s income protection insurance advice and rest easy knowing that you and your family are taken care of financially.

Everything you need to know about life insurance in Australia

When it comes to life insurance, there is a lot of information to take in. Here, we provide an overview of how life insurance works in Australia, including the different types of policies available and how premiums are calculated.

Should you consider a testamentary trust?

Do you have concerns about what will happen to your loved ones after you pass away? This article provides an overview of testamentary trusts and how they can be utilised in estate planning.