Top Tax Tips for Australians in FY24

Table of Contents

ToggleAs we venture into the fiscal year 2024, Australian taxpayers face a landscape filled with both challenges and opportunities. With the Australian Taxation Office (ATO) continually updating its guidelines, it is crucial for individuals and businesses alike to stay abreast of these changes to optimise their financial strategies. This blog post delves into essential tax planning tips designed to navigate the complexities of FY24, ensuring that you are well-prepared to make informed decisions.

Understanding the Basics of FY24 Tax Changes

The FY24 brings with it a slew of legislative adjustments, affecting tax rates and thresholds that are essential for taxpayers to understand. Notably, the alteration in tax brackets can influence your liabilities and planning. For instance, adjustments to the lower tax threshold might decrease the amount of tax payable for some, while increasing it for others depending on their income bracket.

Additionally, specific changes targeting individual taxpayers, such as modifications in the treatment of work-related expenses or investment income, require careful consideration. Understanding these nuances is paramount in planning your tax submissions effectively to avoid pitfalls and capitalise on potential benefits.

Strategies for Maximising Deductions

One of the most effective ways to reduce your tax bill is by maximising deductible expenses. The FY24 sees continuity in the ability to claim deductions for home office expenses due to the ongoing prevalence of remote work. Taxpayers should ensure they accurately calculate the proportion of internet usage, electricity, and office supplies that directly pertain to their work.

Education and professional development expenses remain an invaluable deduction for professionals looking to enhance their skills. Whether it’s a short course or a long-term degree, understanding which educational expenses can be claimed will significantly reduce your taxable income.

Furthermore, charitable contributions continue to be an excellent avenue for deductions. Ensure that donations are made to registered charities and receipts are kept to substantiate these claims.

Investment Income and Capital Gains

Managing investment income and capital gains is critical for tax efficiency, especially with fluctuating market conditions in FY24. Real estate investors need to be particularly vigilant about capital gains tax implications of their transactions. Strategies such as timing the sale of assets or utilising capital losses to offset gains can be beneficial.

For share market investors, understanding the tax implications of dividends and capital gains is vital. Utilising mechanisms like dividend reinvestment plans can defer capital gains taxes, while careful record-keeping can assist in calculating the correct amount of tax owed on investment profits.

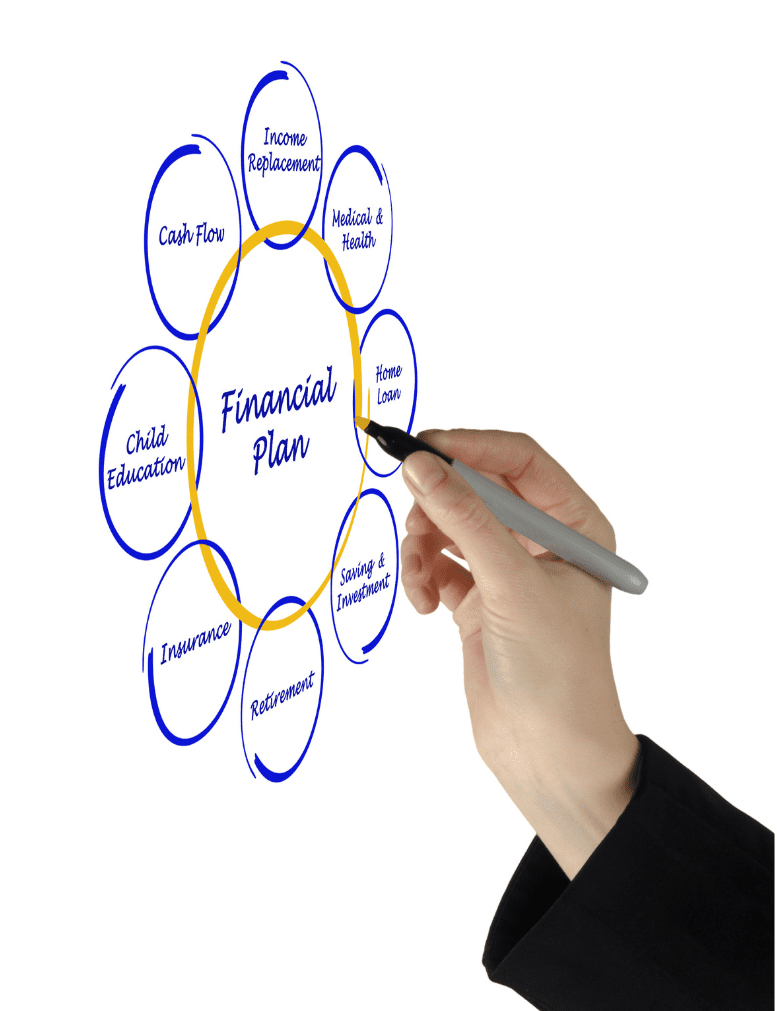

Superannuation and Retirement Planning

Superannuation remains a potent tool in tax reduction strategies. FY24 encourages Australians to consider boosting their super contributions to benefit from lower tax rates on superannuation earnings. Additionally, for those nearing retirement, understanding the tax implications of accessing super early or transitioning to a pension phase is crucial.

Contributing to your super can substantially reduce your taxable income and simultaneously enhance your retirement savings. However, it’s important to be aware of the caps on contributions and the tax penalties for exceeding them.

Utilising Tax Professionals

The complexities of the Australian tax system make it advisable for many to seek professional advice. Whether it’s ensuring compliance with new laws, filing complex returns involving multiple income streams, or planning strategically for future tax liabilities, a qualified tax accountant can provide invaluable assistance.

Employing a tax professional can not only save you a substantial amount in potential tax but also in avoiding penalties for errors or non-compliance. Their expertise in navigating the labyrinth of tax legislation can prove to be an investment that pays dividends in the long run.

Conclusion

In conclusion, preparing for FY24 requires a multifaceted approach to tax planning. By staying informed of the latest tax changes, utilising deductions wisely, managing investment strategies, considering superannuation benefits, and possibly engaging with tax professionals, Australians can not only comply with tax laws but also maximise their financial well-being. Effective tax planning is an ongoing process that can significantly influence your financial future.