Superannuation – The greatest tax avoidance tool

Superannuation - the greatest tax avoidance tool

I’m okay paying tax, but as Kerry Packer famously said, “Of course I am minimising my tax.” And if anybody in this country doesn’t minimise their tax, they want their heads read because, as a government, I can tell you that you are not spending it that well, that we should be donating extra.”

First things first: If you are earning an income or have more complex financial affairs, it’s fine to pay for an accountant to help you. You do not know what you do not know. Their fee can be claimed on your tax return. Let me know if you are looking for an accountant and I can provide some options.

The first change is regarding how you can make superannuation contributions. No longer restricted to business owners, employees too can contribute to superannuation and then claim it back as a tax deduction with the same result as salary sacrificing without annoying your boss. Make sure to complete a ‘notice of intent to claim a tax deduction” form and provide it to your super fund before you complete your tax return. This is extremely important.

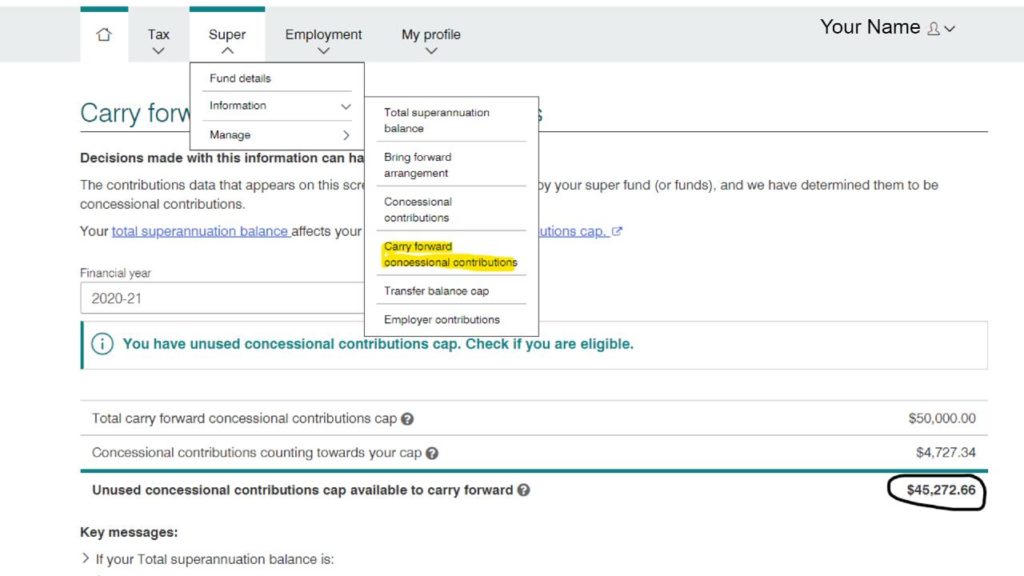

The second change is the rollover of concessional contribution caps. From 1 July 2024, you can each contribute up to $27,500 to superannuation per year for all individuals regardless of age, including employer contributions. Now the unused portion of this will rollover from previous years. This is called “Carry Forward Concessional Contributions“.

You can check this yourself by logging into your MyGov and going to the ATO portal. It will look like below, including a highlighted menu on how to find it.

So, in this example, the person could contribute up to just over $45k and claim it back as a tax deduction.

Of course, you wouldn’t do that for several reasons, including:

- You didn’t earn $45k over the tax free threshold. There is no point in reducing your income below the tax free threshold, as you will still pay 15% contribution tax on your way into super.

- Your superannuation balance was over $500k as of June 30, 2020, making you ineligible.

- You can’t contribute if you are over age 67 and don’t meet the work test (working 40 hours or more in a 30-day period in the financial year).

- You want to access your superannuation funds before retirement or age 60, whichever is longer. You need to balance your retirement goals with your lifestyle goals.

Another thing to consider is the government’s co-contribution. If your income is lower than average, you may be eligible. This allows up to a $500 co-payment from the government if you contribute $1000. There are more criteria, but you can check this calculator from the ATO website to see if you are eligible.

Check the general advice warning below or the disclaimer and not long until end of financial year, some funds have cut-off times more than a week before.