How does inflation impact your portfolio?

Hope for the best, plan for the worst. Inflation is back after 40 years – how does inflation impact client portfolios?.

by Brian Long, Lifespan Senior Investment Specialist – Managed Accounts, Lifespan Financial Planning

The return of inflation

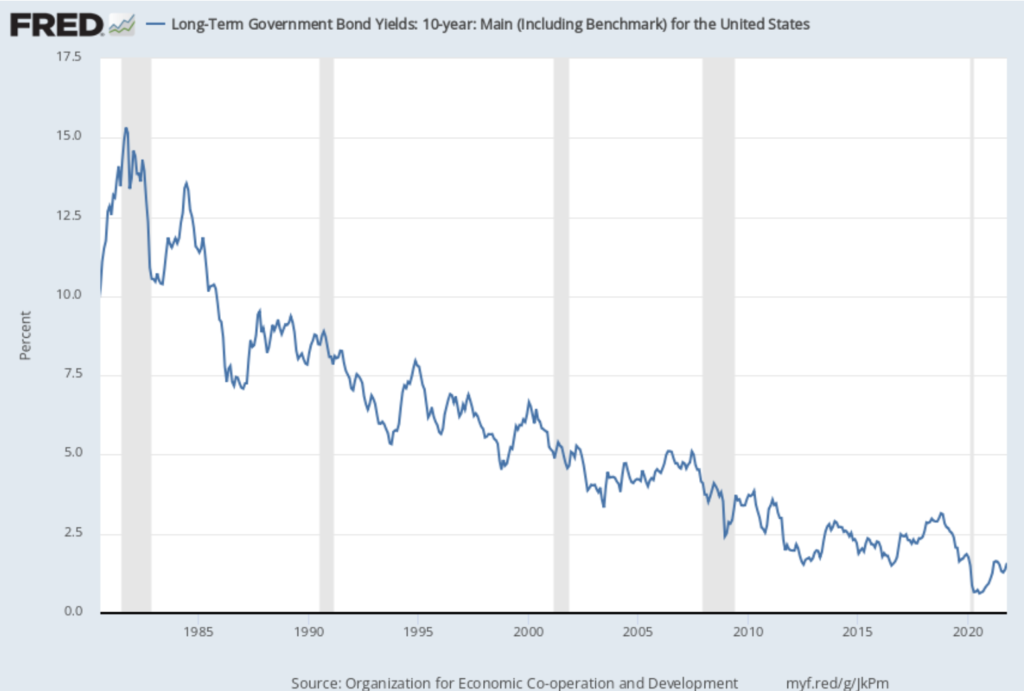

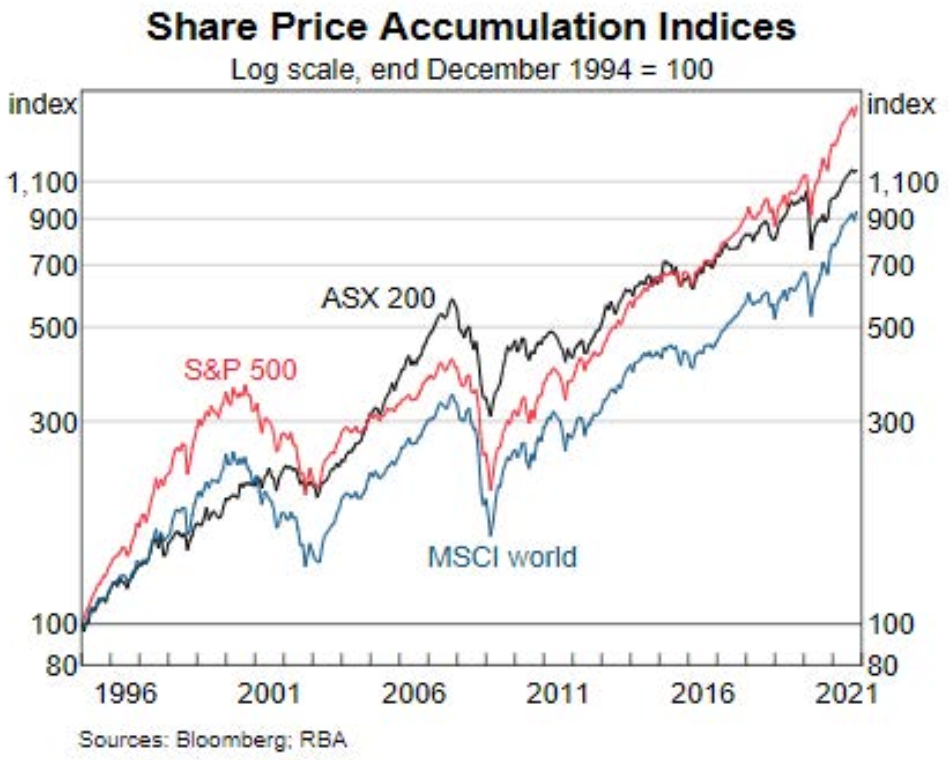

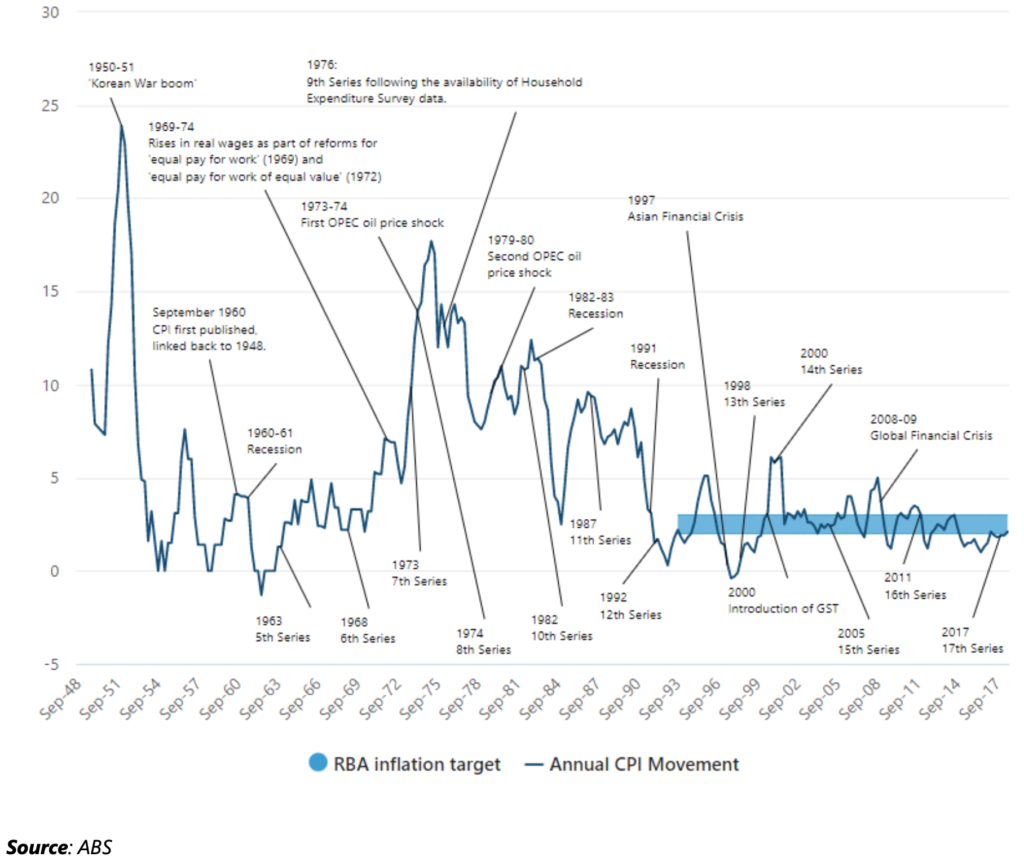

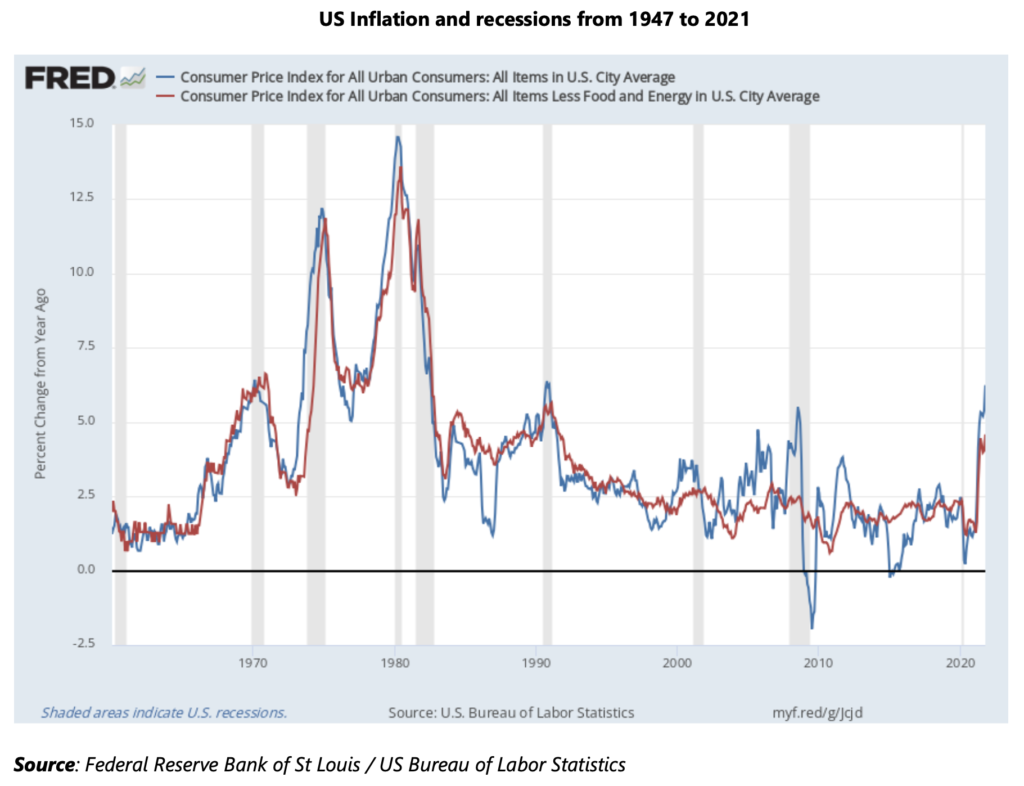

The last 40 years has largely been a period of disinflation – falling inflation and interest rates. This is a very favourable investment environment for risk assets (charts below).

Source: Federal Reserve Bank of St Louis

Over the last year, however, most countries have experienced higher inflation (chart below). The world’s major central banks have been assuring investors that this is just a temporary blip or as Jerome Powell, Chairman of the US Federal Reserve, has repeatedly said, inflation is just ‘transitory. It is arguable that at present central banks are prioritising employment objectives over price stability (inflation) targets.

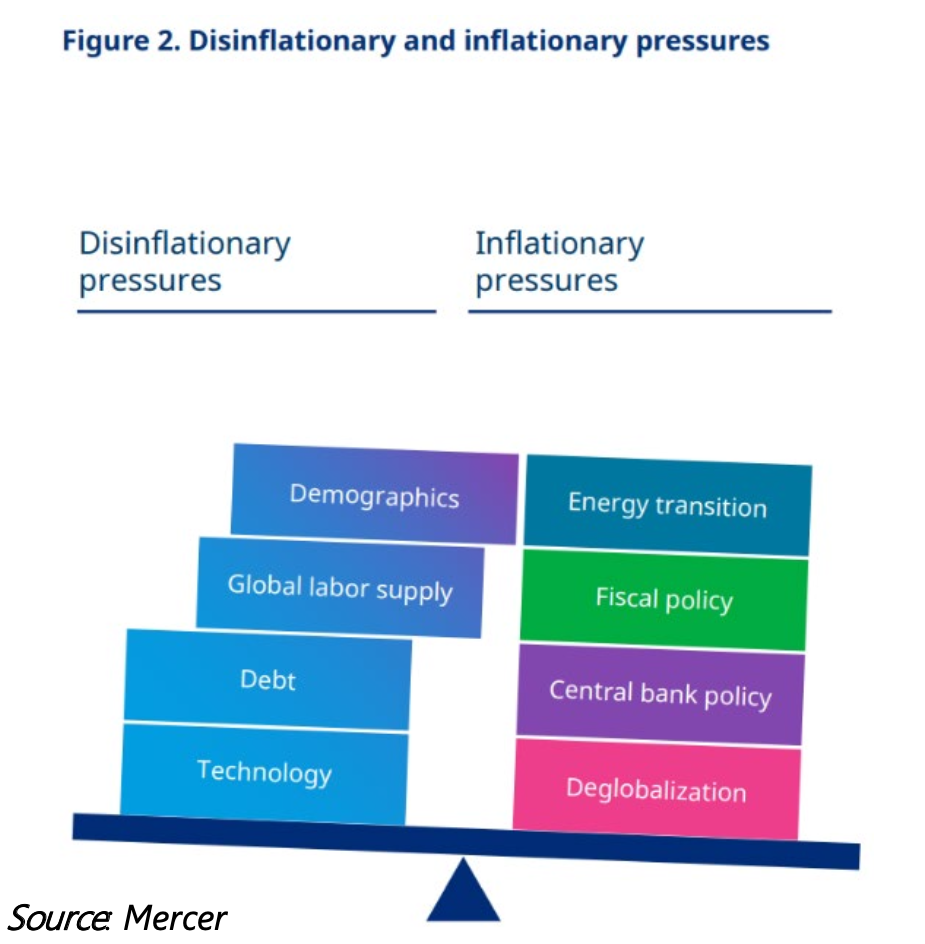

As shown by the diagram below, however, the surge in price increases is becoming broad based, driven by tight global supplies (such as semiconductor chips for the auto industry), longer delivery times, worker shortages in some sectors on the supply side, and increased demand as countries emerge from lockdowns with the benefit of increased savings. The transition away from fossil fuels is a significant factor in energy shortages (especially in Europe).

In recent weeks, in response, many central banks have started to reverse policy. In the US, the Federal Reserve has announced that it will begin to reduce it’s massive $120bn a month quantitative easing programme by $15bn a month and Jerome Powell admitted that inflation is “running well above our 2% longer run goal”. Locally, the Reserve Bank of Australia has ended its policy of yield curve control after a period of turmoil in short-term bond markets.

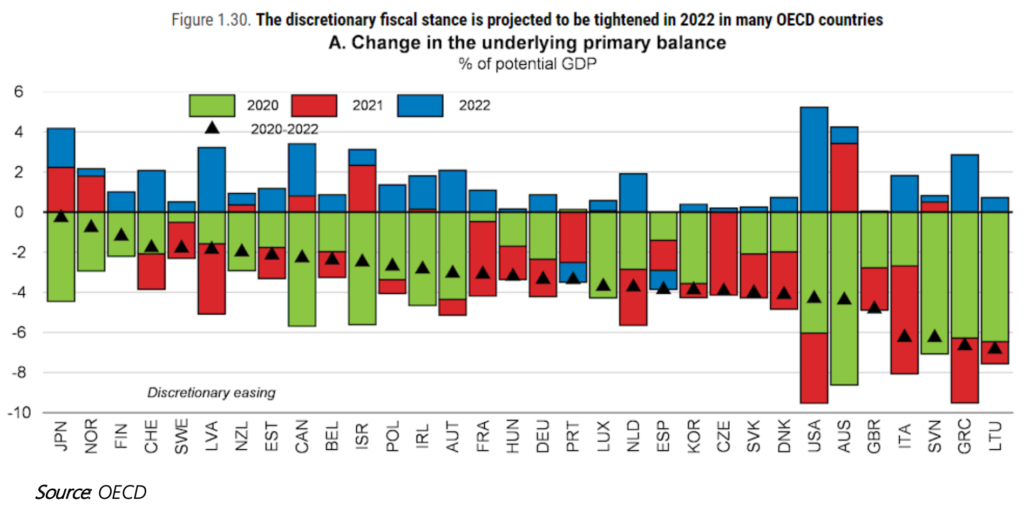

In addition, as the chart below shows, many governments are winding back their stimulus programs.

Why is the market so concerned about inflation?

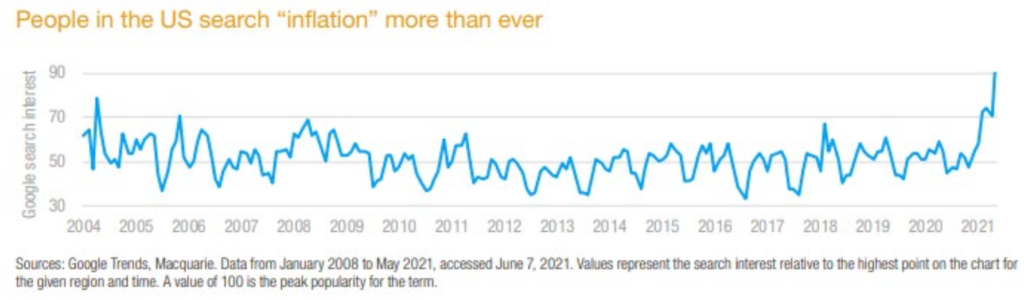

Certainly, investors are very interested in inflation. As the chart below shows, there haven’t been this many people searching for inflation since Google began tracking these search trends.

It’s important to understand however that a degree of inflation is a sign of a healthy economy. People spending money increases corporate profits, encouraging businesses to invest, employ more staff and give wage rises. At some point however rising inflation has the opposite impact, prompting increases in interest rates, reducing business investment, slowing economic growth, and reducing standards of living. This in turn reduces expectations of earnings growth which impacts share prices. This is especially the case for growth stocks which are priced based on long-term earnings. When examining S&P 500 returns by decade and adjusting for inflation, research shows the highest real returns occur when inflation is 2% to 3%. Beyond this, returns become very volatile and generally lower.

Markets are also concerned as that the spike in inflation is occurring at the time where we may be at the end of a long secular economic cycle of disinflation, which was prolonged by the government and central bank stimulus measure since the GFC in 2008. The economy has the highest debt since WW2 at a time when interest rates are artificially low which creates vulnerabilities and a conundrum for central banks. There are other complicating factors as well.

The diagram below illustrates this point.

Inflation has largely been ignored by equity and bond markets, as evidenced by the current level of valuations, although the market no longer believes the transitory story as wages growth lifts and supply pressures increase.

Generally, what concerns the market now however is not the likelihood of sustained high inflation (although this is a possibility), but rather unexpected spikes in inflation or stagflation due to central banks not taking action or to the contrary the recessionary consequences of overreacting and lifting interest rates too quickly and governments prematurely increasing taxes to repay debt. It is these “transition” periods that cause dislocations in the market. The end of the cycle is an added complication impacting longer term portfolio construction.

Overall, even the most optimistic outcome is that inflation will remain above pre-pandemic levels.

The problem for conventional portfolios in periods of high inflation

Most portfolios have been constructed during and for disinflationary environments. This means that the dominant contribution to risk and return has been the equity risk premium. In other words, those asset classes such as equities, real assets, and more aggressive credit-oriented fixed income strategies that are linked to GDP growth, performed well. Even the continual trend of declining yields increased discounted values of dividends and coupon payments.

Further, portfolio efficiency was supported by the typically negative correlation between equities and bonds (duration) which dampened portfolio volatility when periods of market stress occurred. With inflation low and transient, rising inflation was associated with economic growth that benefitted equities and hurt government bonds when central banks adjusted monetary policy which stabilised inflation.

The problem is that the market is far more fearful when inflation is already high and especially at current stretched valuations, equity/bond correlations may fail to work just when investors need them to (as was seen in October).

The conclusions are that a less predictable inflation environment, at the current high valuations, increases complexity for portfolio construction and suggests returns are likely to be lower and more variable going forward.

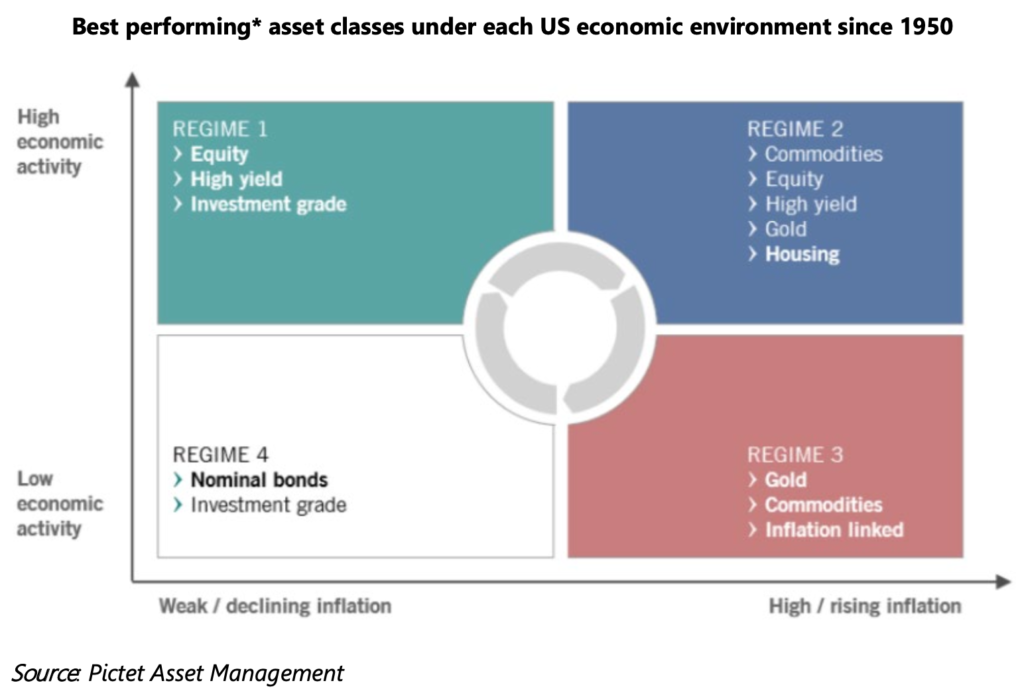

The following diagram illustrates this point:

Portfolio construction strategies in different inflationary environments

Further, while Australia has fared well for many years, periods of high inflation frequently coincide with recessions elsewhere as shown by the following chart:

There are many portfolio construction challenges when deciding how to respond to different inflation regimes. Two major ones are:

The difficulty in predicting the timing and degree of the change, much of which depends on the actions of the US Federal Reserve.

Asset classes perform quite differently in different inflationary environments.

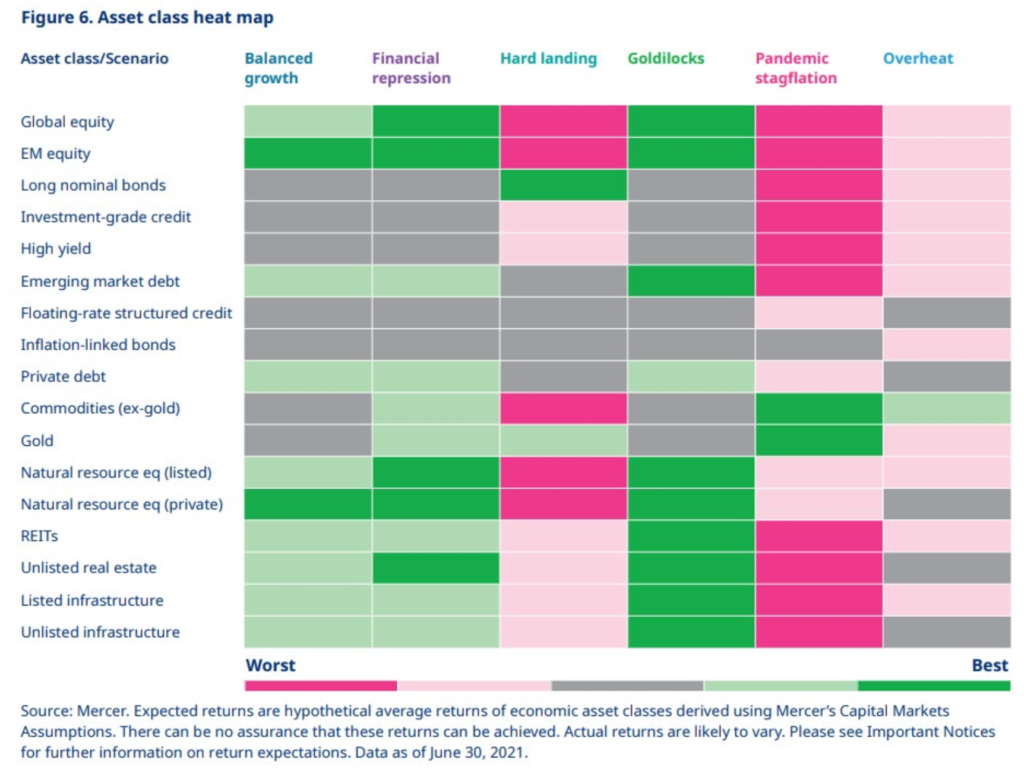

The following chart from Mercer illustrates the latter point for six inflation scenarios. The changing pattern of returns is the point rather than the detail behind each scenario.

The definitions for each scenario are described in Appendix 1.

So how can advisers respond to inflation?

It is a challenging environment for investors: yields are low, spreads are tight, equity valuations are expensive, and the long-term return outlook is depressed. We now have an inflation issue to deal with for the first time in a generation. The market is quite divided on the question of whether it will be transitory, persistent, or even cause a meltdown. Much will depend upon the actions of a few central banks, especially the US Fed, and whether the bond market believes the ongoing guidance.

In the face of such uncertainty, what should advisers do in such an environment? In Lifespan’s view the answer as always comes down to two fundamental points:

The importance of having a robust investment and portfolio construction philosophy, consistently applied, that has been proven through a range of economic cycles

Understanding the needs and goals of the client.

Investment Philosophy

In such an environment, it is not feasible to build an “optimal” portfolio that will constantly shift to outperform at all times as the level of inflation changes. Nor is there a default strategy that works all the time across all possible scenarios. Even inflation-linked bonds, which may appear as the most intuitive solution given their contractual link to inflation, do not perform well in many inflationary scenarios. This is because, in the near term, they are more exposed to changes in real rates than to changes in inflation expectations and in the longer term, investors are locking in negative real rates by investing in inflation-linked bonds.

The core of Lifespan’s Investment Philosophy, therefore, is a pragmatic solution to build robust portfolios that can cater for a variety of economic conditions that can withstand multiple outcomes, supported by a decision-making framework that can quickly adjust portfolios to provide favourable risk/return outcomes. Our recommendation to advisers (reflected in our model portfolios and managed portfolios) is for portfolios to include:

A strategy that is well diversified by asset class; risk premia and investment manager

Active investment managers

Active management of the asset allocation

A blend of managers with a range of exposures to growth, value, cap bias, and region (including emerging markets) in the case of equities and to duration, credit risk, and absolute return in the case of fixed income

The flexibility to introduce new asset classes, such as growth and defensive, alternative assets and real assets (such as commodities, global macro), low volatility equities, long/ short. Care needs to be exercised with assets such as inflation-linked bonds, gold, and commodities that have mixed records over the long term. Alternatives and real assets also tend to have high costs.

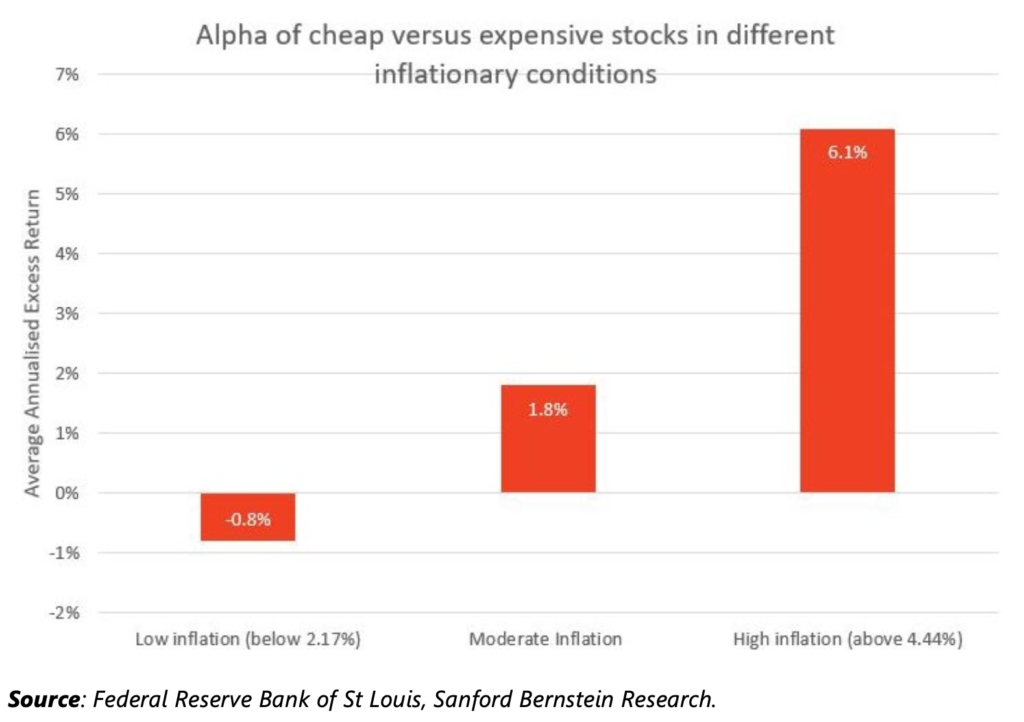

For equities, despite their volatility, a well-structured equity portfolio is core to an investment strategy as they are a long-term source of wealth. Our exposure to managers with a growth bias in our managed portfolios has performed well in low inflation. Growth stocks, including income-oriented stocks, however, tend to decline in inflationary periods (as the discount rate on future earnings increases). Accordingly, we also have significant exposure to value stocks, which are inexpensive on an absolute basis hence offer the opportunity to make positive real returns over the long term should inflation return. This is illustrated by the chart below:

Data shows cheapest versus most expensive quintile on price to book using a monthly average of rolling 5-year annualised returns from 1960 to June 2021.

We also think active management is essential in equities, as for example, the continued strength of the FAANGs and Microsoft has created a concentration risk in the S&P 500, not dissimilar to the concentration in the ASX200 for resources and financials.

Care and an active approach need to be taken with emerging markets equities. The underlying inflation driver is critical in deciding which emerging countries to include in the portfolio.

Property may be useful in inflationary environments (both G-REITS and A-REITS). They are currently attractive as they offer the potential for capital growth and they have a positive real yield. They must be managed actively as rentals need to be able to respond to inflation. Policy settings are attractive for REITS as is the reopening of economies.

Likewise, it is important to have a fixed income portfolio that can cater to different inflation environments. This is especially important as people move into retirement and want to preserve capital and secure a reliable income stream. Fixed income however is becoming increasingly complex.

At a time when long term bond yields are very low (and negative in real terms), it is critical to have other sources of return in fixed income portfolios, especially as an increase in real interest rates will cause a capital loss in long term bond allocations. Our managed portfolios have a variety of managers and strategies to deal with this as follows:

Short Duration strategies -These strategies reduce the sensitivity of the portfolio to rising interest rates and seek to deliver excess returns either through a focus on short-dated corporate credit or via a broader set of return drivers, such as rates, spreads, and currencies

Absolute Return Fixed Income (AFRI) strategies provide investors with access to a broad global opportunity set of alpha sources. When combined with flexible investment techniques (e.g., hedging), they are expected to show a low correlation with the overall direction of interest rates and credit spreads, with a greater focus on alpha to help deliver returns

Tilt towards floating rate assets – These strategies can be found in ARFI, multi-asset credit, and securitised credit strategies

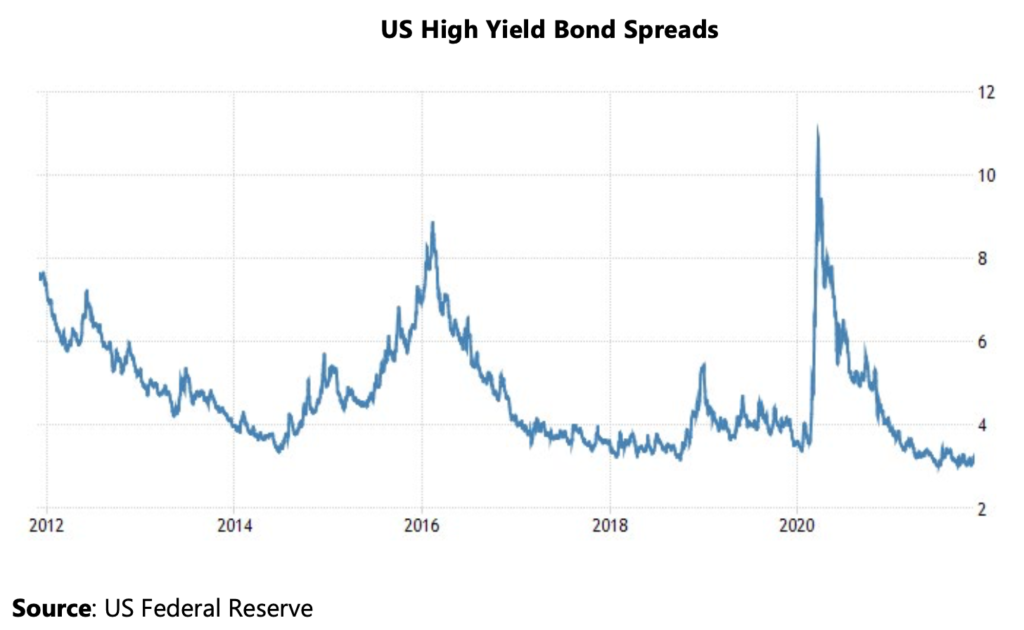

Active management of credit quality – it is important to employ managers that are conscious of credit/ default risk and are well diversified in managing fixed income portfolios. This is important for example in high yield and emerging markets debt allocations

Valuation aware with the ability to rotate out of unfavourable asset classes –While rising interest rates are generally positive for short duration strategies, as they are symptomatic of the economy doing well, at some point in the interest rate cycle this can also trigger increased defaults. Further some assets represent a poor risk/return trade-off. As can be seen below some 85% of US high yield securities have a negative real return.

The needs and goals of the client

Just as there is no silver-bullet portfolio that protects against all inflation scenarios, advisers know that no two clients are alike in preferences and financial situation.

Firstly advisers need to look at the starting portfolio and determine under which economic scenario the asset mix (including wealth outside of super) is vulnerable.

Clients that are near or in retirement will be sensitive to inflation in two ways – firstly as their spending power will be reduced and secondly their increased vulnerability to a sequencing risk event. Such an event can significantly reduce the longevity of their portfolio.

Such clients will be sensitive to the time horizon that their inflation sensitive assets – such as equities and real assets, provide protection. They would be more interested in an inflation hedged highly diversified portfolio. Allocations to commodities and natural resource equities and potentially emerging market bonds may be part of such a portfolio. They will also need a fixed income portfolio that provides a good level of cashflow while protecting against capital loss.

Accumulation clients under say 55 on the other hand will be less sensitive to inflation risk and will continue to see equities as the driver of long term wealth.

Also relevant is the type of inflation protection needed, for example, education and healthcare increase in cost at a far greater rate than CPI.

Clients that desire additional potential downside protection than available in a strategic asset allocation strategy may wish to invest in a portfolio that uses tactical asset allocation. Lifespan offers advisers 3 series of tactical asset allocation portfolios (comprising 15 model portfolios) with a range of potential downside risk protection ranging between 25% TAA/ 75% SAA; 50%TAA/50% SAA and 75%TAA/25% SAA. Each of these have five risk profile based portfolios ranging from conservative to high growth.

The client tolerance for complexity and the frequency of changes in the portfolio will be an important factor in responding to all inflationary circumstances.

Conclusion

While it is difficult to predict whether the current levels of inflation will be sustained or transitory, Lifespan believes we are nearing the end of the economic cycle where we need to plan for increased market volatility and structure portfolios for a regime shift away from disinflation.

Whether we like it or not, the possibility of substantially greater inflation as well as a more volatile and low-returning investment and economic climate may be upon us. The consequence will be that people will no longer be able to grow wealth reliably by doing it themselves. Additionally, speculative forms of investments will no longer provide the attractive payoffs of the past. This will create an environment where advisers can demonstrate the value of advice and the benefits of robust diversified portfolios backed by a strong governance framework.

Advisers can take comfort in Lifespan’s experience in supporting advisers through many economic cycles. Our model portfolios and managed portfolios will assist advisers to navigate the road ahead.

Appendix 1

Mercer Economic Scenario descriptions

Balanced growth, where economic growth and inflation both moderate over time, consistent with consensus forecasts. This assumes the current level of inflation is indeed transitory, even if inflation remains slightly elevated. Under this scenario, rates normalize, but the need for an aggressive response is avoided.

Financial repression shares similarities with the 10 years following World War II, the last time government debt was at today’s level. In both cases, an adverse external event (war and pandemic) required large government outlays. Rather than repaying the debt with higher taxes, it is monetized by central banks holding rates low despite sustained high inflation, which supports overall growth.

Hard landing assumes a return to fiscal austerity, not necessarily as a deliberate choice but because of political gridlock. This would likely lead to a sharp slowdown in growth and falling inflation.

Goldilocks is a more optimistic version of the balanced growth scenario, in which a post-pandemic productivity boom, driven by the accelerated digitalization of economies and strong private and public investment, likely leads to sustained growth above consensus and low inflation.

Pandemic stagflation. Is a severe bear case that captures the most worrisome inflation impact. Here, we have a scenario in which the COVID-19 situation deteriorates again because of waning vaccine efficiency and/or vaccine- resistant strains. New lockdowns lead to another growth collapse and simultaneously compound the already severe supply chain stress, driving inflation higher — the nightmare scenario of simultaneous recession and high inflation.

Overheat scenario incorporates the classic reaction function of central banks tightening policy pre-emptively to avoid runaway inflation, which has often triggered recessions in the past.