Everything you need to know about life insurance in Australia

When it comes to life insurance, there is a lot of information to take in. This can be especially daunting for those who are looking for their first policy or are unsure about how the process works. Here, we provide an overview of how life insurance works in Australia, including the different types of policies available and how premiums are calculated. So, if you’re considering taking out life insurance, make sure to read on!

Life Insurance in Australia

Life insurance in Australia is designed to provide financial protection for you and your family in the event of your death. There are a range of different policies available, which can be tailored to suit your individual needs. For example, you can choose to take out cover for a specific period, or you may want to have cover that lasts until you choose to cancel at some point in the future. Premiums are calculated based on several factors, including your age, gender, smoking status, and the amount of cover you require. Some providers give discounts over a certain level of cover, so make sure you investigate higher levels of cover to see if that can be provided at a lower cost.

Types of Life Insurance Policies

There are two main types of life insurance policies in Australia: Term life insurance and whole life insurance.

Term life insurance

Term life insurance provides cover for a set period, typically between one and a maximum age. If you die during this time, your beneficiaries will receive a lump sum payment.

Whole life insurance

Whole life insurance provides cover for your entire life. This means that if you continue to pay your premiums, your beneficiaries will receive a payout when you die. These types of policies are no longer available in Australia but were popular during the 1970s and 1980s.

When it comes to choosing a life insurance policy, it’s important to consider your individual needs and circumstances. For example, if you have young children, you may want to take out cover until they reach adulthood.

Considerations when calculating the life insurance sum insured

There are a few things to consider when calculating the life insurance sum insured.

- You need to think about how much debt you have and how much of that debt you want to be covered by life insurance.

- You need to consider your future income needs or expenses that you want to be covered by life insurance as a lump sum.

- You need to think about any immediate expenses such as funeral costs and time off work for your partner.

- You need to consider any legacy needs that you might have.

All these factors will help you determine the right life insurance sum insured for your needs.

There are several ways to apply for life insurance in Australia. You can purchase life insurance in Australia through your superannuation fund, directly through the insurance provider such as on TV, through an insurance broker, or through a financial adviser.

When applying for life insurance in Australia, you will need to provide some personal information such as your name, date of birth, and contact details. You will also need to disclose any medical conditions that you have and provide details of your lifestyle, including your smoking status and whether you play any dangerous sports. Once you have provided this information, the life insurance company will assess your risk and give you a quote. If you are happy with the quote, you can then proceed with the life insurance policy.

Having life insurance is one of the most important things you can do to protect your family. If something happens to you, life insurance will pay out a death benefit to your loved ones. This can help them cover funeral costs, pay off debts, and maintain their standard of living. Life insurance can also give you peace of mind, knowing that your family will be taken care of financially if something happens to you.

Fully underwritten life insurance policy

A fully underwritten life insurance policy is one that is underwritten before you purchase it. This means that the life insurance company will review your medical history and other factors to determine whether you are eligible for coverage. If you are not eligible for coverage, the life insurance company will not sell you a policy. A life insurance policy that is underwritten at claim time is one that is not underwritten until you make a claim. This means that the life insurance company will review your medical history and other factors after you die to determine whether you are eligible for coverage. If you are not eligible for coverage, your loved ones will not receive a death benefit.

The benefits of a fully underwritten life insurance policy are certainty and peace of mind. When you purchase a fully underwritten life insurance policy, you know that you are covered, and your loved ones will receive a death benefit if something happens to you. With a life insurance policy that is underwritten at claim time, there is no guarantee that your loved ones will receive a death benefit.

Benefits of obtaining financial advice on life insurance

The benefits of obtaining financial advice on life insurance in Australia are numerous. Here are a few:

- A financial adviser can help you understand the different types of life insurance policies available and choose the right one for your needs.

- A financial adviser can help you compare life insurers and find the best deal on cover.

A financial adviser can provide valuable guidance on how much life insurance cover you need and how to keep your premiums affordable.

Considerations when choosing a beneficiary for your life insurance policy

If you have life insurance in Australia through your superannuation or a policy that you purchased directly, you may be wondering who will receive the proceeds of the life insurance in the event of your death. While it is possible to simply list a beneficiary in a life insurance policy, there are a few other things that you should keep in mind when making this decision.

- You should consider whether you want the life insurance proceeds to be paid out to your estate or directly to the beneficiaries. If you choose to have the life insurance paid out to your estate, it will be subject to probate and may be subject to income tax. On the other hand, because the life insurance proceeds are paid directly to the beneficiaries of a deceased estate, they will not have to pay probate fees or income tax on the proceeds.

- You should consider how much life insurance you need. You don’t want to leave your beneficiaries with too much life insurance money that they will be unable to manage.

- You should review your life insurance policy regularly and update it as needed. This will ensure that the life insurance policy is up-to-date and that the beneficiaries are still accurate.

By following these tips, you can ensure that your life insurance policy is set up in a way that best meets your needs and those of your beneficiaries.

Taxes on life insurance

When it comes to life insurance in Australia, there are a few things to keep in mind about taxation. First and foremost, life insurance is not taxed in Australia when paid out of pocket. This means that the premiums you pay are not tax deductible. However, if your life insurance policy is held within your superannuation, the premiums may be tax deductible. When it comes to payout, the benefits of life insurance may be taxable if paid to someone who is considered a non-superannuation dependent.

The Claims Process

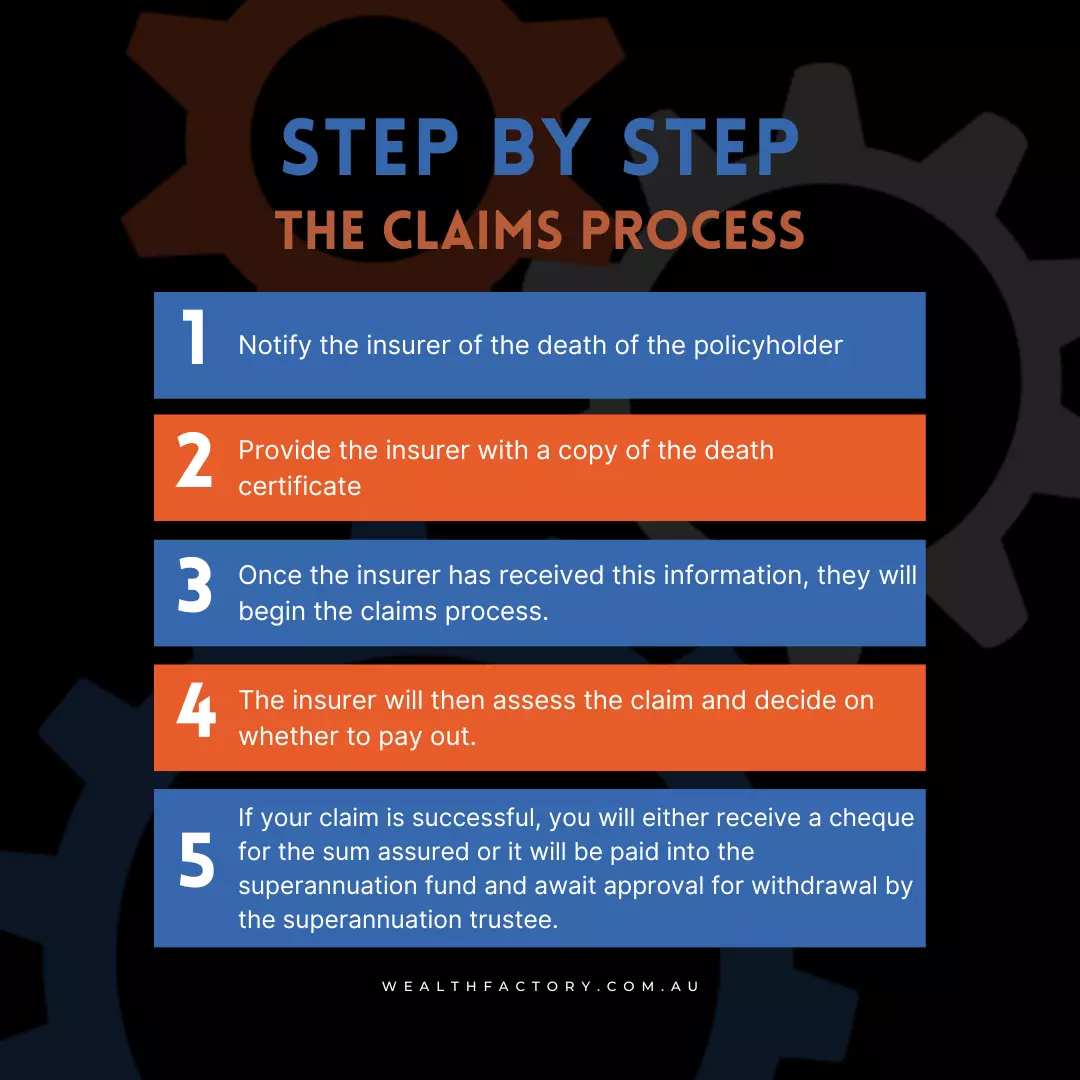

If you have life insurance in Australia, you may be wondering how to make a claim. The claims process can vary depending on the insurer, but there are some general steps that you will need to follow.

First, you will need to notify the insurer of the death of the policyholder. This can usually be done by calling the customer service number or sending a letter. You will then need to provide the insurer with a copy of the death certificate.

Once the insurer has received this information, they will begin the claims process. They will likely ask you for additional information, such as the policyholder’s medical history and beneficiary details. The insurer will then assess the claim and decide on whether to pay out. If your claim is successful, you will either receive a cheque for the sum assured or it will be paid into the superannuation fund and await approval for withdrawal by the superannuation trustee.

Considerations before you cancel your life insurance policy

If you’re like most people, you probably don’t think much about your life insurance policy until it’s time to renew it. But what happens if you need to cancel your life insurance policy? Whether you’re no longer required to have life insurance or you’re simply switching to a new provider, there are a few things you need to consider before you cancel your policy.

- Check with your life insurance company to see if there are any penalties for cancelling your policy. Some companies may charge a fee, while others may require that you pay the remainder of your premium.

- Make sure you have another life insurance policy in place before you cancel your current one. Otherwise, you and your family could be left without coverage in the event of an unexpected death.

Consider your financial goals and needs before cancelling your life insurance policy. If you’re no longer required to have life insurance, or if you have other coverage in place, then cancelling your life insurance policy may make sense for you. However, if you’re still in need of life insurance coverage, then it’s important to weigh the costs and benefits of cancelling your policy before planning.