Financial Adviser and Founder

Wealth Factory is a financial advisory company that specialises in providing advice and services to people who are looking for the best way to plan for their retirement. The company is run by Rob Laurie, a qualified financial adviser with over 10 years of experience in the industry. Wealth Factory provides clients with tailored advice, which includes goal setting and detailed planning strategies.

Wealth Factory believes it is important to have a professionally guided perspective on how you will live after work or if you need assistance deciding what your goals should be; this is why we offer comprehensive personalised retirement plans based on each individual client’s needs and lifestyle aspirations.

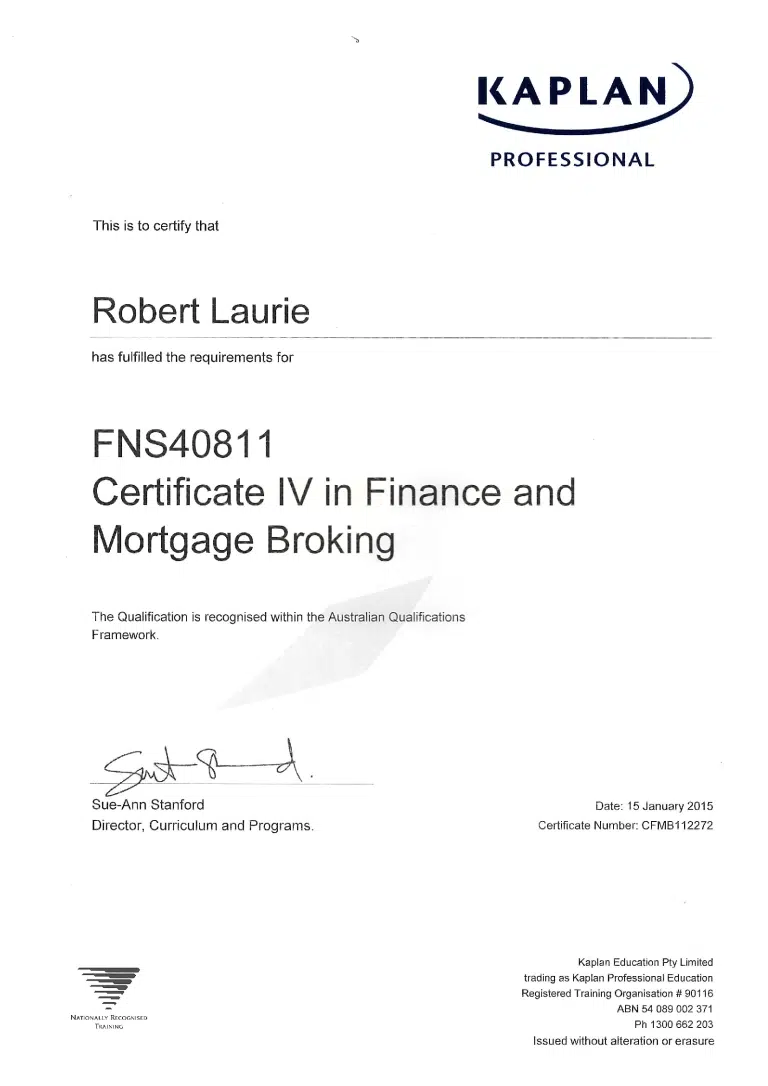

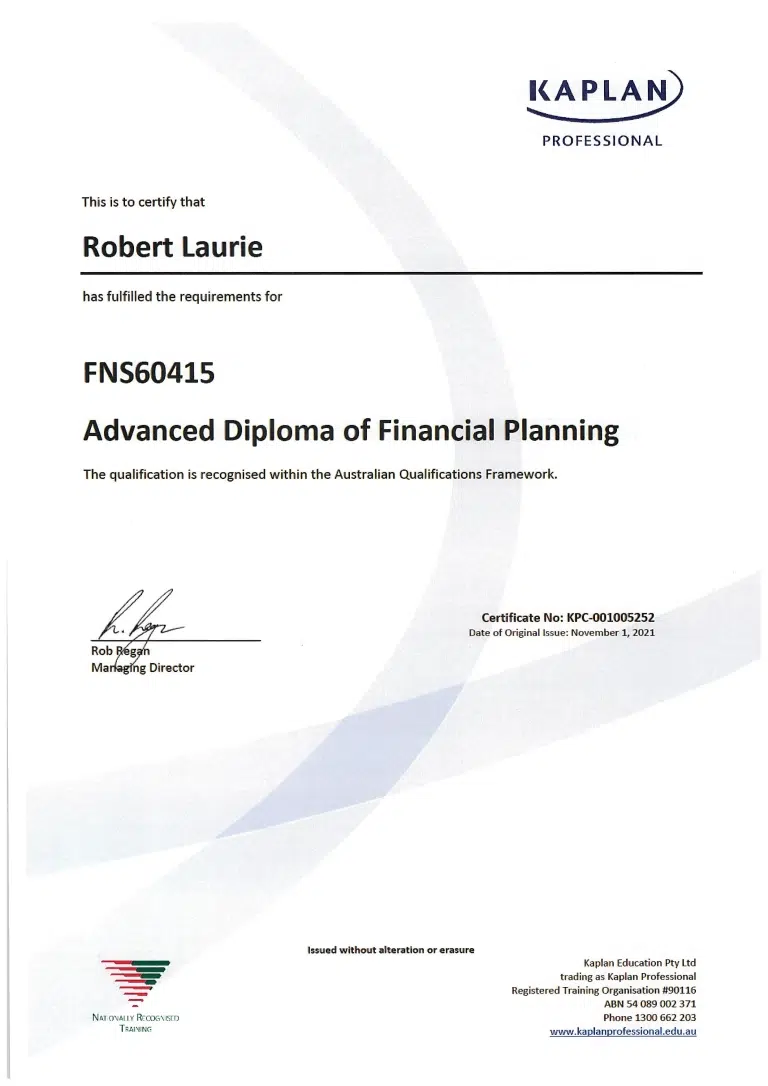

Rob Laurie is a financial adviser (ASIC # 425270) and has been providing financial advice since 2012. In 2014, he started his own business as his employer was retiring from the industry. RJL Financial Pty Ltd, trading as Wealth Factory (ABN 91 600 073 630), and Rob Laurie are Authorised Representatives of AFSL (229892).

Rob Laurie is an experienced financial services professional and has been working in the financial advice profession since 2012. He started out in 2006 with a major insurance company, helping people protect what was important to them.

After a period of time, he became frustrated with not being able to help people more comprehensively with their financial affairs, so he decided to move into providing holistic financial advice.

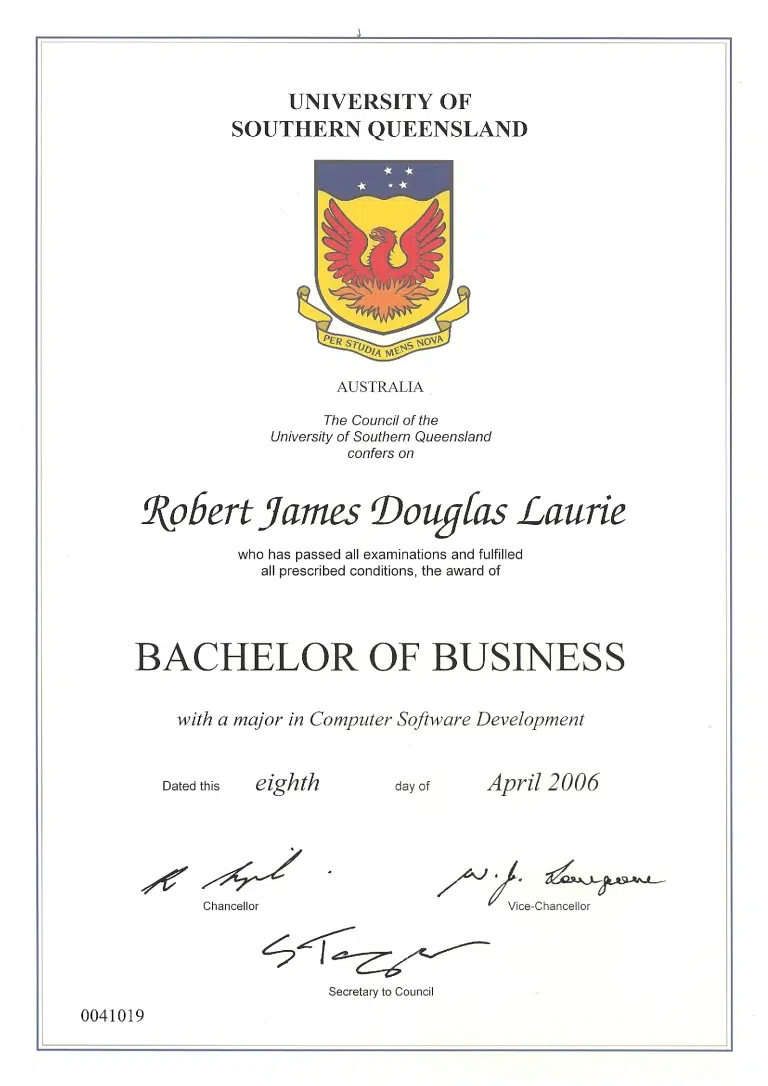

Rob moved to Toowoomba, Queensland from Bundaberg to study at the University of Southern Queensland in January 2000. He studied for a Bachelor of Business with a major in Computer Software Design and a minor in Business Management.

While working in insurance, Rob also ventured into eCommerce with a successful side hustle eBay store, selling thousands of motorcycle goggles and sunglasses. He currently has a couple of other business projects boiling away in the background to diversify income streams, so he understands the needs of business owners well.

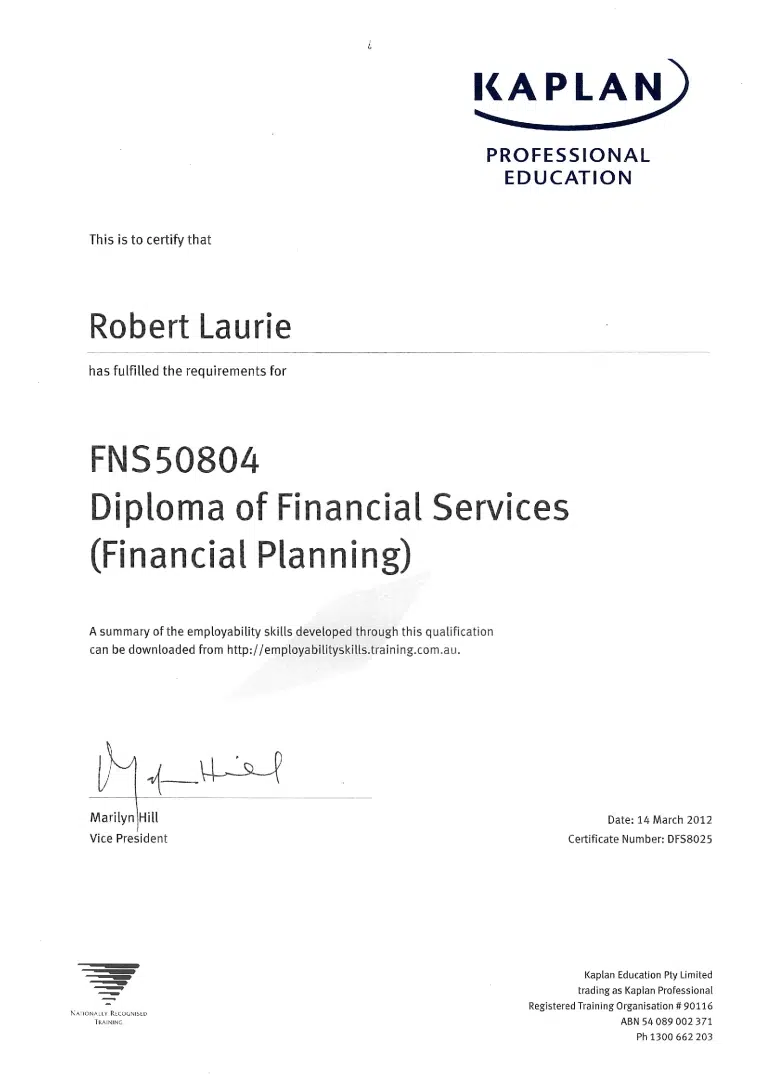

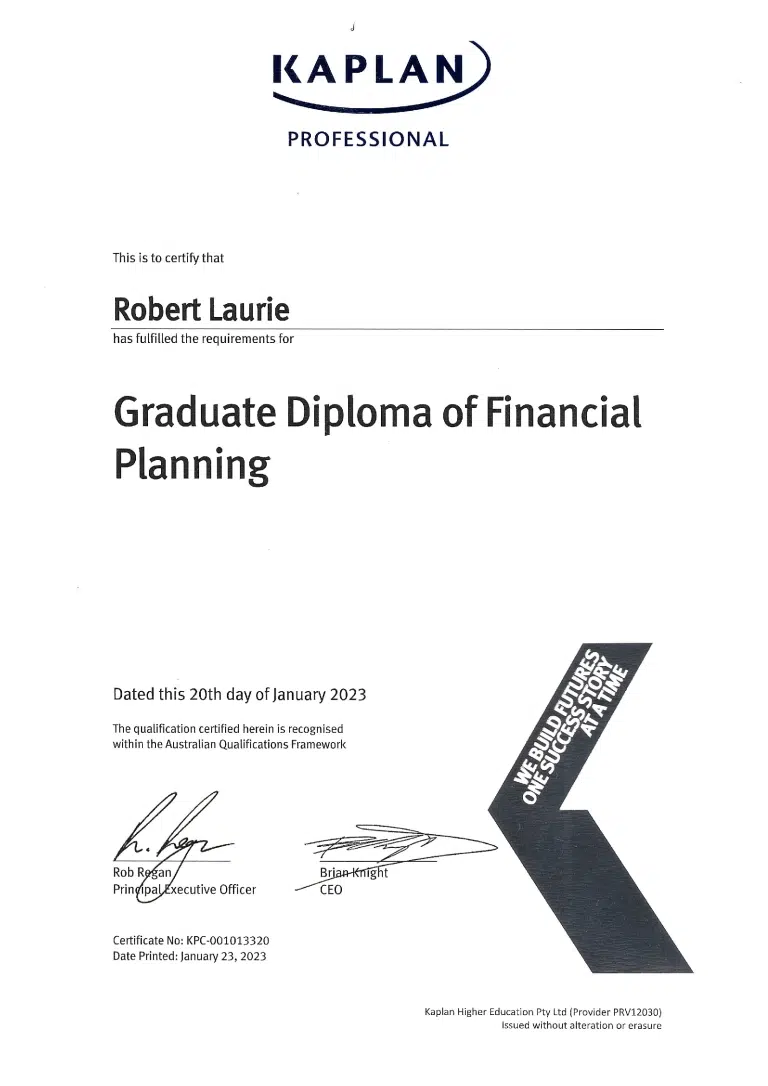

Rob started studying for his financial planning qualifications after seeing many people panicking and making poor financial decisions during and after the Global Financial Crisis years.

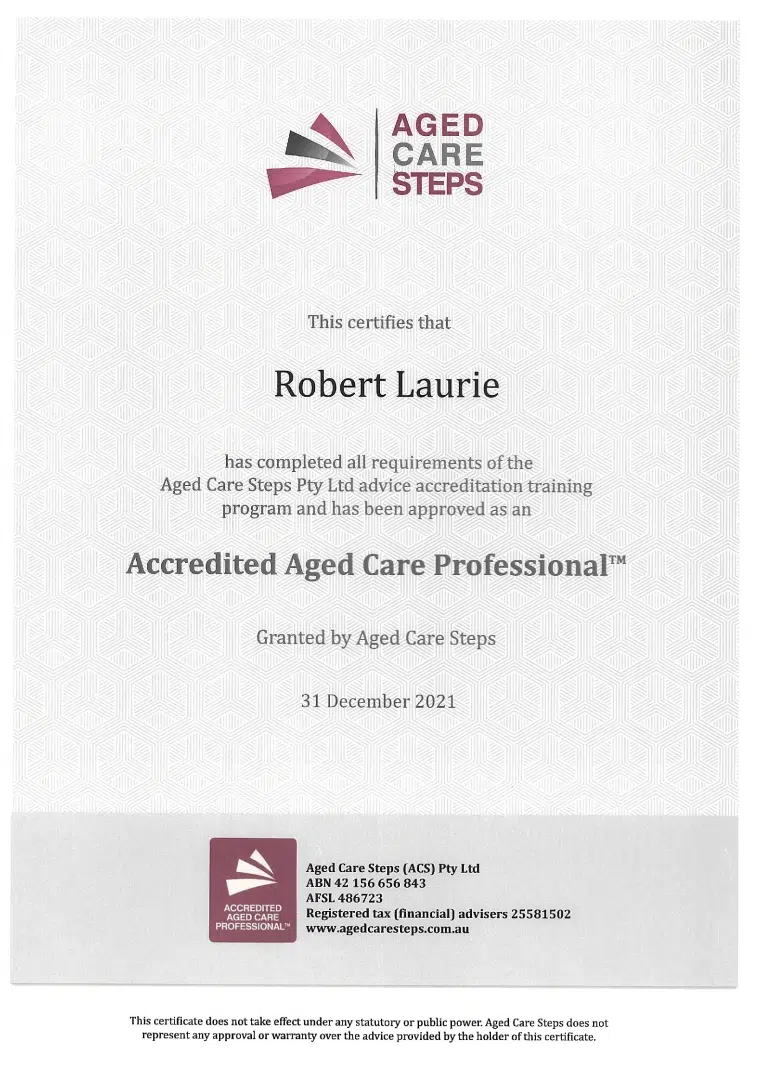

For years now, Rob has worked strategically with his clients in the provision of superannuation and retirement planning and enjoys the technical and complex areas of the financial advice landscape. What this means to you is that you can benefit from Rob’s skills and experience to ensure you have the best quality financial advice tailored to meet your specific needs and objectives both now and in the future.

Along with his education and accreditations, Rob also has a passion for helping his clients enjoy their best retirement possible by personalising strategies and aligning their plans to meet their needs. He is also conscious of balancing cash flow, investment market movements, and overlaying complex government legislation and rules.

As a member of the Association of Independently Owned Financial Professionals, Rob is updated on industry and legal issues and is required to undertake continual accreditation, professional development, and training. He is also committed to meeting the strict professional standards of conduct as defined in the AIOFP Code of Ethics and Standards of Professional Practice.

Rob has also taken the Banking & Finance Oath, with this commitment affirming that he respects the position of trust that society affords to him and supports the vision of a banking and finance industry that meets the community’s needs and has its full confidence, thereby fulfilling its integral role in society.

Wealth Factory possesses the necessary experienced personnel and technology to provide you with quality financial advice, backup service, and an ongoing review of all your financial planning needs. Along with your financial planner, you will also have support from a Client Administration Manager who assists with all administrative queries and changes along the way.

We utilise Midwinter’s AdviceOS Technology, the latest in hi-tech financial planning software available. This enables Wealth Factory to provide our clients with an overall financial planning capability from the most basic plans through to complex strategies including Centrelink & Social Security planning, Taxation calculations, complex investment & diversification planning, DIY Superannuation Investment strategies, Redundancy & Retirement advice to cover your “overall” financial situation.

Who is Lifespan Financial Planning (Our Licensee)

Lifespan Financial Planning Ltd (AFSL) is one of Australia’s largest privately owned adviser communities, delivering tailored business support, education, and a robust and reasonable compliance approach that helps you put your client’s needs first.

Lifespan was awarded the 2021 CoreData Licensee of the Year and Licensee Leadership Award, and Dealer Group of the Year in the IFA Excellence Awards 2021, after being a finalist in 2015 and 2018-2020. This is amazing recognition of the hard work and dedication of all of the Lifespan team and confirms that the support and service that we provide our adviser community continues to be valued and appreciated.

Worried About Your Finances? You’re Not Alone.

Financial advice can help you protect your wealth and increase it over time.

Robert Laurie Authorised representative 425270 and RJL Financial Pty Ltd trading as Wealth Factory ABN 91 600 073 630 Corporate Authorised Representative 463041 are authorised by Lifespan Financial Planning AFSL 229892

LOCATION: 300 Ruthven Street Toowoomba QLD 4350

CALL US: 07 4659 5222

BUSINESS HOURS

Mon – Fri…….. 8am – 6pm AEST

Sat – Sun…….. Closed

Disclaimer: The purpose of this website is to provide general information only. It is not intended to be financial advice, however, any advice provided is general in nature and does not consider your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please speak to your Lifespan financial adviser before making any financial decisions.