The Autumn season 2021 update is here!

Vaccine rollout accelerates as bond yields spike

We talked previously about equity markets rallying in anticipation of the vaccine rollout and the positive impact of the gradual reopening of economies. The global vaccine rollout is now well underway. The one concern is that the new COVID-19 variants (UK, South African) will require updated vaccines.

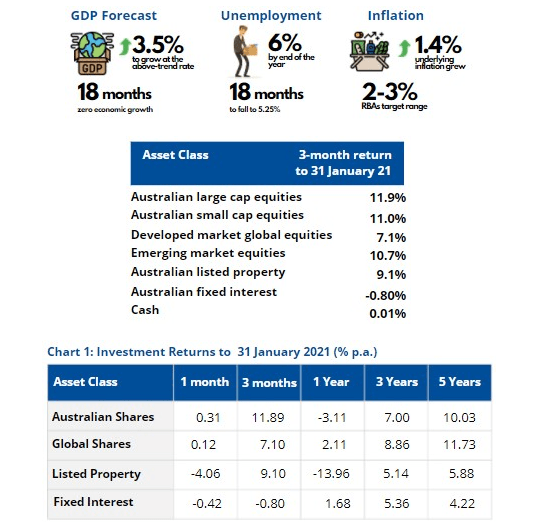

In Australia, the recovery from COVID-19 is well underway and the economy is not as bad as initially feared. In August, the RBA forecast unemployment to be around 10% by the end of 2020, and still be above 7% by the end of 2021. Unemployment peaked at 7.5% in July 2020 and fell to 6.6% in December.

According to Dr. Stewart Lowe (RBA Governor), the main two reasons for this being:

• Our success in containing the virus which limited the extent of lockdowns.

• Government fiscal policy support has been bigger than expected, at around 15% of GDP.

The massive Quantitative Easing (QE) program continues in the US, while in Australia, the RBA doubled its QE program to $200 billion. The program is due to run until September, but there is a strong possibility it will be ongoing.

Dr. Lowe said the board was not expecting to increase the cash rate for “at least three years “, while the US Fed sees no material movement in US interest rates until 2023. They do not expect the jobs market to deliver strong wages growth to Australian workers until at least 2024. The implication is extremely low yields in fixed interest for the next few years. These settings strongly favour Growth Assets in terms of yield and total return.

Company earnings are on the UP

Economies and companies are rebounding. Brokers are forecasting Australian June 30 earnings to get back to pre-pandemic levels. According to UBS, with around 40% of the ASX 100 having reported, earnings per share growth estimates for the 2021 financial year have been revised up 2.1% to 28.8%.

However, valuation is an issue, particularly in the US. Australian equities (ASX 200) trading at a PE (price-to-earnings ratio) of 19.5x at 31 December 2020 are now trading at over 20 times June earnings. The US (S&P 500) is currently trading around 22.5x, well above long term average levels of around 17 times. Very low interest rates and strongly rebounding economies (e.g. US forecast growth around 6% in 2021) are the main justification for current valuations.

The major issue in markets right now is the sharp rise in long-term bond yields, signalling that markets are worried about future inflation. Higher growth can also lead to higher interest rates. Whatever the reason, higher bond yields normally result in lower PE multiples for stocks.

The US 10-year bond yield has increased from around 0.8% in late October 2020 to over 1.3%, which is about its pre-COVID-19 level. The move in Australia’s 10-year bond yield has been even more dramatic, rising from around 0.8% to 1.68%. The spike in yields has led to underperformance in high PE tech stocks (growth stocks in general) and prompted a move into more cyclical or economically sensitive stocks, such as financials and resources.

This should be positive for Australian equities relative to global equities given the proportion of cyclical stocks in our market. One ‘downside’ to this cyclical recovery has been the strength of the Australian dollar which impacts foreign earnings and is a drag on domestic economic growth and employment growth. One of the major reasons for the QE program by the RBA is to limit the rise in the Australian dollar, a battle it is currently losing.

We will be maintaining our strategic weighting to growth assets but we would be cautious in the short-term. It is natural for bond yields to rise as growth picks up, but we are closely watching the current move. We are still not at a level of interest rates which would significantly impact the broader market, but we would certainly like to see the trajectory of this rise start to flatten out.